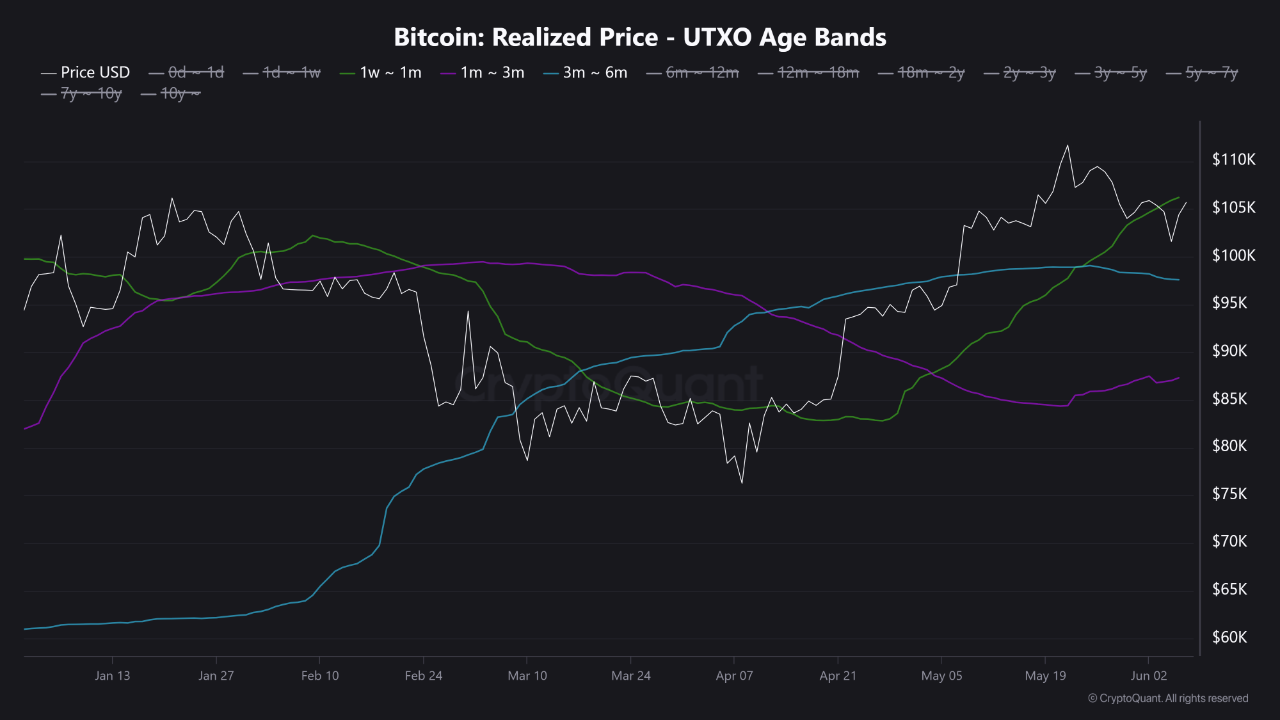

A recent report from CryptoQuant outlines the average entry prices of short-term BTC holders, helping define the market’s most critical near-term levels for resistance and support.

Short-term holders who bought within the past one to four weeks have an average entry price of $106,200.

Those who entered between one and three months ago have a cost basis around $87,300. Meanwhile, the three to six-month cohort has an average entry price of $97,500.

These cost basis levels reveal where traders may react emotionally—either by taking profits or entering new positions.

Why These Levels Matter Now

When Bitcoin returns to a trader’s break-even price, many choose to exit, especially if they’ve experienced recent volatility. This dynamic turns $106,200 into a potential resistance zone, as short-term holders look to sell and reduce risk.

On the other hand, levels like $97,500 may become key support zones, where fresh buyers step in, viewing the price as a value opportunity.

As CryptoQuant notes, understanding where short-term holders are positioned helps traders identify zones of fear and opportunity.

What to Watch Next

CryptoQuant highlights two price levels that could play a decisive role in Bitcoin’s short-term trend:

$106,200 is likely to act as resistance, as short-term holders may begin taking profits at that level. $97,500 is viewed as a support level, where buyers may re-enter the market and absorb selling pressure.These two zones will be crucial in determining whether Bitcoin continues consolidating or makes a decisive move in either direction.

The post Key Bitcoin Price Levels Revealed: What You Need to Know appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·