In the wake of recent price volatility sparked by a public feud between President Trump and Elon Musk, market participants began questioning the strength of Bitcoin’s current bull cycle.

But according to Carmelo Alemán, a Verified On-Chain Analyst at CryptoQuant, the fundamentals remain firmly intact—and in fact, look stronger than ever.

Alemán’s latest report points to a convergence of critical on-chain metrics that together form a powerful bullish narrative.

Exchange Reserves Drop: Supply Tightens

Bitcoin reserves on centralized exchanges have declined sharply. Over the past week, balances dropped from 2,435,613 BTC to 2,365,410 BTC, marking a 2.88% reduction.

This trend is significant for three reasons:

It reduces available supply, easing sell-side pressure. It signals investor confidence in holding rather than trading. It reflects Bitcoin’s growing appeal as a store of value. Realized Cap Hits New All-Time HighBitcoin’s Realized Capitalization—which reflects the total cost basis of all BTC in circulation—has surged to a new all-time high of $934.88 billion.

This rise indicates:

Continued buying at higher price levels. Ongoing capital inflow into Bitcoin. Reinforcement of long-term holding behavior. Netflows Confirm Accumulation ModeThe netflow of BTC on exchanges has remained consistently negative, confirming that more Bitcoin is being withdrawn than deposited.

This supports the previous metrics, suggesting that the broader market remains in accumulation mode, not distribution.

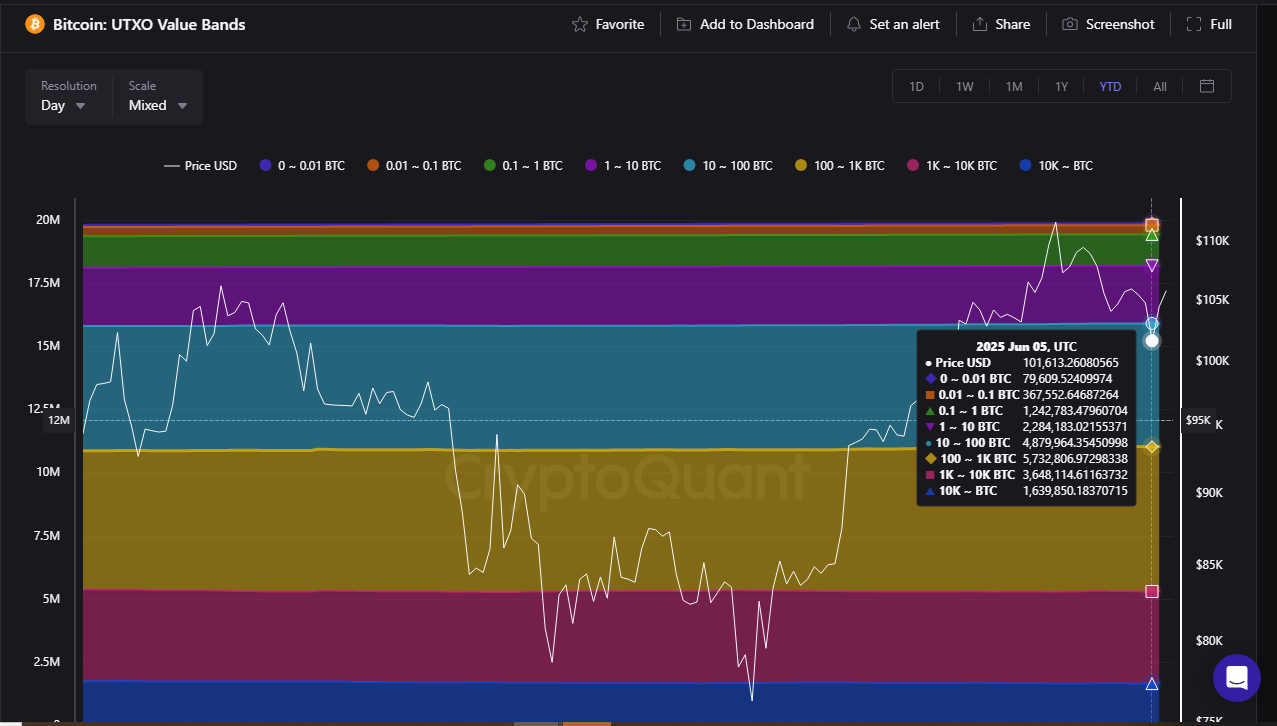

UTXO Value Bands: A Healthier Hold Base

Alemán also highlights positive trends in UTXO Value Bands, which track Bitcoin held across different wallet sizes and time horizons.

Key takeaways:

BTC is being held by a diverse set of investors. There’s rising conviction across both retail and institutional holders. Selling pressure is decreasing across all value bands.Conclusion: On-Chain Structure Remains Bullish

Despite short-term market noise, Carmelo Alemán concludes that Bitcoin’s on-chain structure is decisively bullish. With shrinking exchange supply, record-breaking realized cap, and strong accumulation patterns, Bitcoin appears primed for its next major upward leap.

“These trends are not isolated,” Alemán notes. “Together, they reflect a structural shift where long-term conviction is overtaking short-term speculation.”

The post Bitcoin’s On-Chain Metrics Signal Next Major Price Leap – What Could Be Next Stop appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·