These developments come amid improved trading volumes, an uptick in price, and early signals of momentum change from key indicators, positioning FLOKI for a possible upside continuation if confirmed by further buying activity.

Short-Term Recovery Emerges After Consolidation Breakout

The 1-hour chart of FLOKI/USD reveals a clear downtrend from June 2 to June 5, marked by lower highs and lower lows. However, a bullish engulfing pattern on June 6 reversed this trend, initiating a recovery that was followed by a sideways consolidation phase. During this phase, the price remained between $0.0000850 and $0.0000880, showing signs of stabilization.

A breakout on June 10 lifted the token above $0.0000900, peaking above $0.0000930. Although the move was short-lived, the price remained elevated above the prior consolidation range, suggesting that the $0.0000880 level may now act as support.

Source: Open Interest

Supporting this breakout was a spike in aggregated open interest, indicating increased trader participation. Notably, open interest surged alongside the June 6 rebound, pointing to the establishment of new long positions. However, post-breakout, open interest declined, implying that many participants may have exited after the initial price push.

This divergence—price rising while open interest falls—can indicate weakening bullish conviction. As a result, a sustained move higher may depend on renewed volume and fresh long positions entering the market.

Daily Activity Reflects Momentum, But Cautions Remain

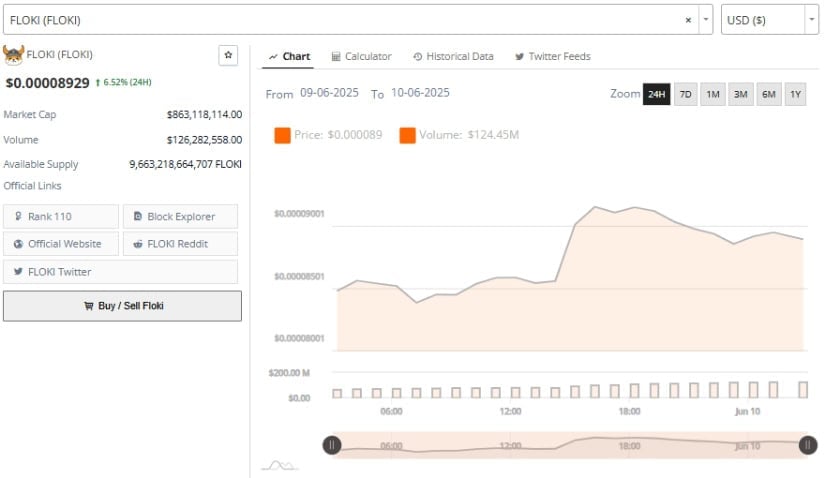

Additionally, the 24-hour performance chart from June 9 to June 10 shows a 6.52% price increase for FLOKI, closing at $0.00008929. This upward trend began gradually in the early hours and gained strength by midday, aligning with a breakout and subsequent surge in trading volume.

The day’s peak activity was accompanied by volume exceeding $126.28 million, suggesting strong market engagement. However, as the session closed, both price and volume began to retreat slightly, implying that some traders were taking profits.

Source: Brave New Coin

From a liquidity and valuation perspective, FLOKI maintains a market capitalization above $863 million, supported by a circulating supply of nearly 9.66 trillion tokens. Its performance during this session highlights increased attention from both retail traders and potentially short-term speculators.

While price action was bullish within this window, sustaining such moves will depend on continued momentum and broader market sentiment. A failure to hold above key support could result in a reversion to earlier trading ranges.

Floki Price Prediction 2025: Weekly Indicators Signal Early Momentum Shift

On the longer-term timeframe, the weekly chart of Floki price prediction presents early indications of a potential trend reversal. The current candle, as of June 10, shows an 8.17% gain and forms a higher low compared to prior weeks, suggesting early accumulation. Though not yet breaking key resistance levels, this pattern points to a gradual shift in sentiment. If the trend continues, it may provide a foundation for a medium-term rally.

Source: TradingView

Technical indicators reinforce this cautious optimism. The Chaikin Money Flow (CMF) remains negative at -0.17, but the upward slope suggests declining selling pressure. If the CMF crosses into positive territory in the coming sessions, it could confirm the emergence of new buyer interest.

Meanwhile, the MACD (Moving Average Convergence Divergence) shows the MACD line climbing toward a bullish crossover, while the histogram has already turned positive at 0.00000495. This signal is often seen ahead of sustained bullish trends, particularly if supported by increasing volume.

Additionally, if the price breaks and holds above the $0.00010 psychological level, this would serve as a key confirmation point. From there, traders may look toward higher resistance levels, including potential medium-term targets around $0.00013 and $0.00020. As of now, FLOKI remains in a potential accumulation phase, with technical indicators beginning to align in favor of further upside, pending confirmation from market volume and buyer follow-through.

1 day ago

12

1 day ago

12

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·