The firm’s latest report raises red flags about the sustainability of the rally and signals a cautious outlook on ETH’s current trajectory.

Rally Fueled by Hype, Not Fundamentals

According to 10x Research, Ethereum’s price has climbed sharply in recent sessions—but the underlying fundamentals don’t justify the move. They point to a buildup in leverage and aggressive positioning by derivatives traders as the main force behind the rise, rather than organic demand or protocol growth.

The firm notes that while Bitcoin has managed to break through the $106,000 resistance zone, its breakout lacks strength. The pattern is even more evident in Ethereum, where the rally has been amplified by gamma hedging linked to call options and speculative flows—not long-term investor conviction.

Circle’s IPO: Catalyst or Distraction?

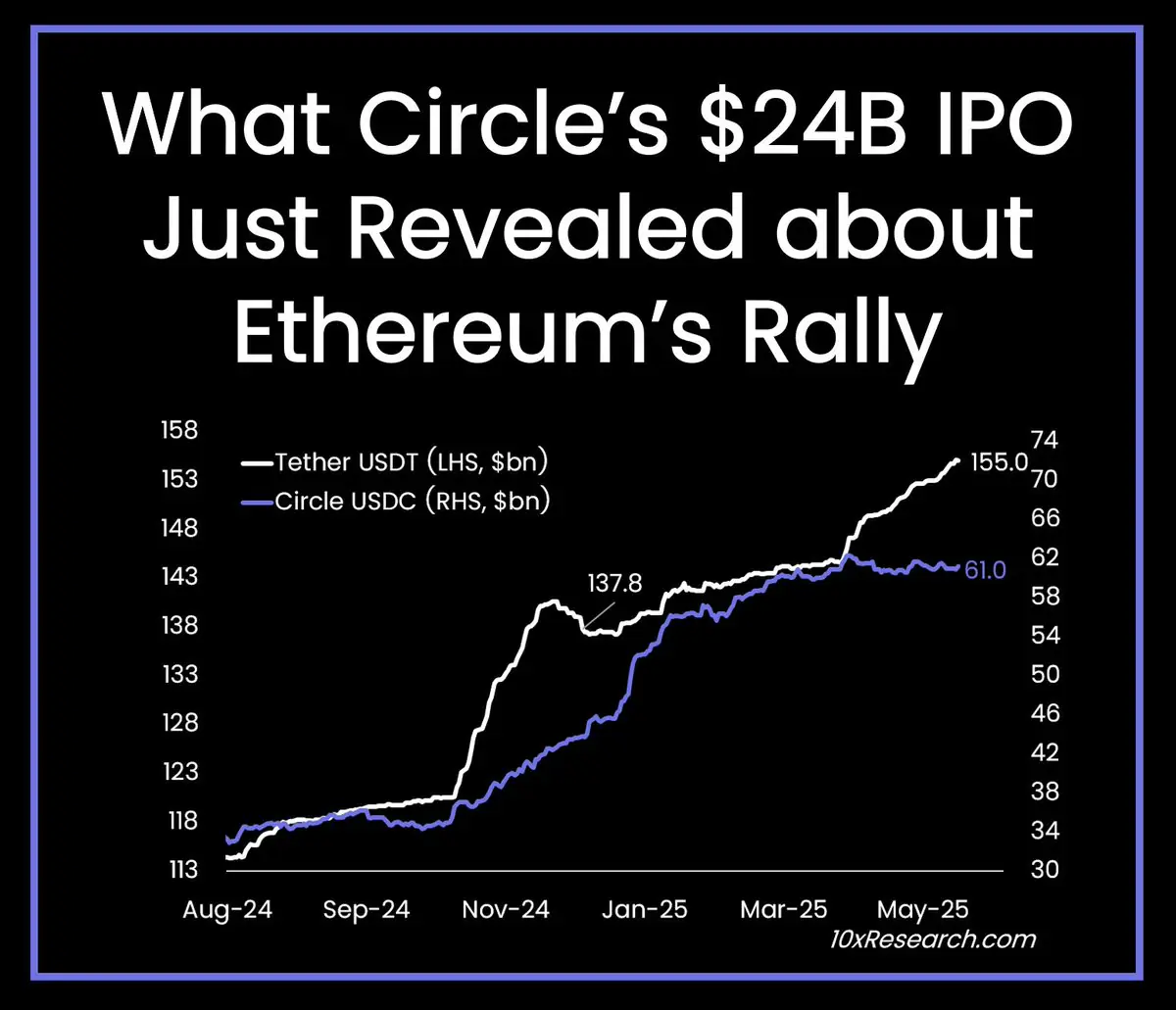

Circle’s high-profile IPO has added fuel to the bullish narrative, especially for Ethereum-based tokens due to USDC’s foundational role in DeFi. However, 10x warns that this market response may be overdone, given that broader structural issues—such as regulatory uncertainty and weak usage growth—still linger.

ETF inflows and recent signals from the SEC regarding DeFi oversight have further complicated the picture, creating a temporary storm of optimism. But the report questions whether this is the start of a new bull leg or merely a setup for a reversal.

A Smarter Play Emerges

Amid the noise, 10x Research highlights one emerging pair trade that they believe is grounded in fundamentals rather than hype. While they didn’t disclose the specifics in the tweet, the suggestion implies a shift toward selective, thesis-driven strategies over broad speculative exposure.

As leverage continues to rise and headline-driven rallies take center stage, 10x Research urges caution: “This market is being driven more by excitement than evidence.”

The post Circle’s $24B IPO Sparks Ethereum Rally—But Cracks Are Forming appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·