This projection, if realized, would mark a transformative moment in global finance, positioning Ripple’s XRP at the heart of cross-border liquidity networks.

Ripple Aims to Revolutionize Global Settlements

Speaking to a packed audience, Garlinghouse underscored the strategic focus of Ripple’s long-term vision. “There are two parts to SWIFT today: messaging and liquidity. Liquidity is owned by the banks. I think less about the messaging and more about liquidity. If you’re driving all the liquidity, it is good for XRP… so I’ll say five years, 14%,” he said.

Ripple CEO Brad Garlinghouse stated at the APEX 2025 event that XRP could capture 14% of SWIFT’s transaction volume within five years. Source: JackTheRippler via X

Garlinghouse’s comments have reignited enthusiasm in the XRP community, with many interpreting this as a clear signal of Ripple’s intent to scale XRP’s role in global settlements.

Why Liquidity, Not Messaging, Is Ripple’s Focus

Unlike SWIFT, which acts as a global messaging system for interbank transfers, Ripple is targeting the core challenge of liquidity. Ripple’s On-Demand Liquidity (ODL) product leverages XRP as a bridge asset, enabling near-instant cross-border payments while eliminating the need for pre-funded nostro accounts.

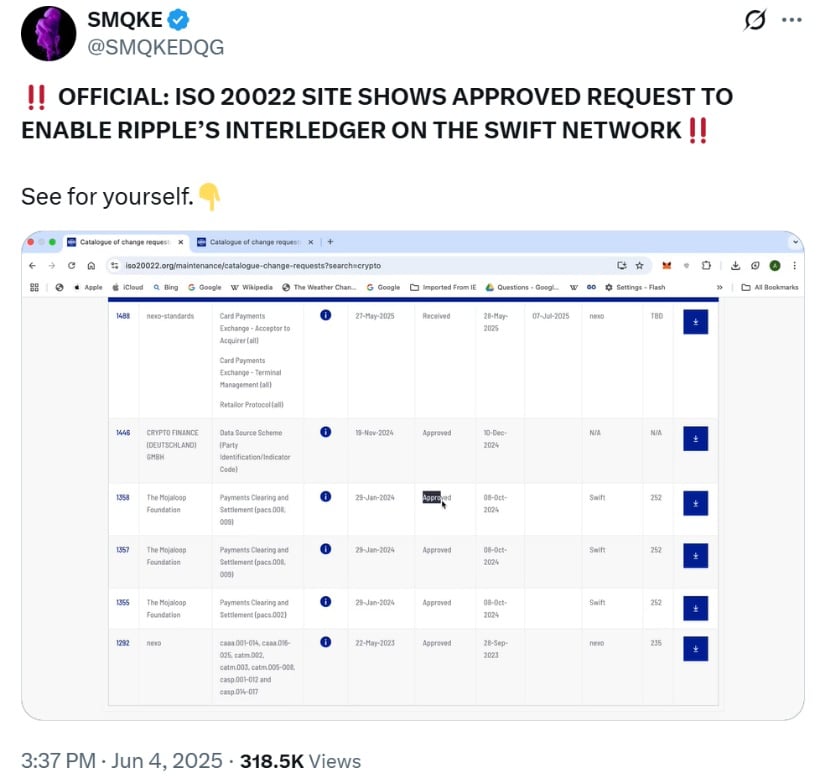

The ISO 20022 site confirms an approved request to enable Ripple’s Interledger protocol on the SWIFT network. Source: SMOKE via X

Garlinghouse’s remarks reflect a belief that the future of finance will be determined by which networks can best facilitate the movement of value—not just the communication around it. With XRP ledger transactions confirming in seconds and offering significantly lower error rates than SWIFT’s infrastructure, the efficiency advantage is clear.

Ripple’s Chief Legal Officer added that the upcoming wave of tokenized assets could further drive the adoption of XRP, stating, “Hundreds of billions of tokenized global assets [will emerge] fairly quickly,” emphasizing XRP’s potential as foundational infrastructure.

XRP Price Prediction: What Happens If Ripple Hits Its Target?

If Ripple captures 14% of SWIFT’s $5 trillion in daily volume, the implications for XRP price could be staggering. Analysts and AI platforms have weighed in with speculative yet data-backed forecasts.

According to DeepSeek AI, XRP could reach:

$63.88 in a base-case scenario, $170 in a bullish scenario, and Around $25.55 in a bear case, depending on adoption rates and token velocity.Meanwhile, Grok AI estimates the price range could fall between $100 to $500, assuming XRP handles $700 billion in daily volume. Even with just 1% of SWIFT’s market share, XRP could potentially hit $35.80, the model suggests.

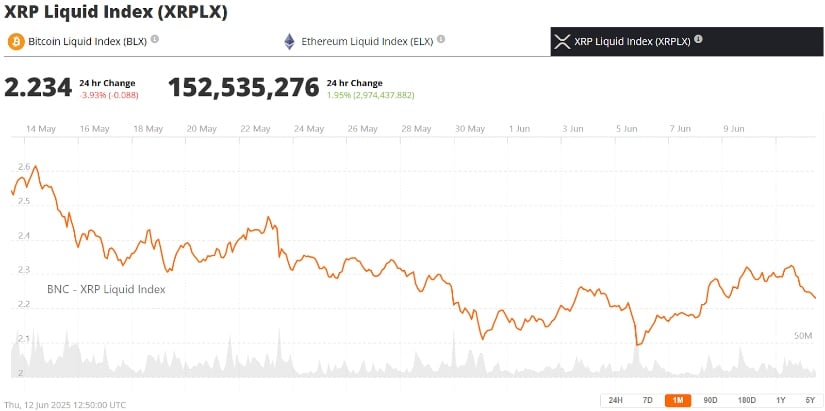

Ripple’s XRP was trading at around $2.23, down 3.93% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

However, these are speculative predictions based on assumptions of broad adoption, liquidity velocity, and institutional engagement. “The math shows ambition, but execution risk is extreme,” DeepSeek cautioned, adding that institutional accumulation around the $2.50 level may be a key technical indicator to monitor.

Ripple’s Expanding Network and U.S. Momentum

Ripple’s expanding presence in the U.S. banking sector has also become a major driver of optimism. Following a favorable outcome in the long-running XRP lawsuit against the U.S. Securities and Exchange Commission (SEC), the firm saw a “surge” in domestic partnerships, Garlinghouse confirmed.

The 2024 Ripple SEC lawsuit resolution not only removed regulatory overhang but also opened the door for potential innovations like an XRP ETF and broader regulatory clarity—especially under the crypto-friendly Trump administration.

Ripple now boasts over 100 financial institutions in its ecosystem, many of which are SWIFT-connected banks, offering a potential bridge between legacy systems and blockchain rails. This has spurred speculation about a Ripple-SWIFT collaboration or integration, though nothing has been officially confirmed.

Community Reaction: “He Means It”

XRP community leaders and influencers have reacted positively to Garlinghouse’s comments. Prominent figure @Nietzbux remarked, “When he speaks, he means it; it eventually comes true,” suggesting that the CEO’s forecast is more than just optimistic rhetoric.

Others have highlighted that the XRP Ledger (XRPL) is already capable of handling significant liquidity volumes and that the infrastructure is in place for scaled adoption—pending further institutional buy-in.

If Ripple succeeds, the Ripple currency price could reflect demand not only from speculative investors but also from global liquidity providers using XRP as a settlement bridge.

Can XRP Truly Compete with SWIFT?

Despite the excitement, industry experts caution that Ripple’s 14% market share goal is ambitious. SWIFT is entrenched in the global financial system, serving over 11,000 institutions across 200+ countries. Ripple, while growing, still operates a comparatively smaller network.

Ripple sets its sights on reclaiming crypto momentum as XRP Coin pursues SWIFT market share following legal victory and amid global uncertainties. Source: MackAttackXRO via X

Further, Ripple crypto adoption has been slowed in the past by regulatory challenges, such as the now-resolved SEC Ripple lawsuit. The volatility inherent in XRP and competing technologies, including Ripple’s own RLUSD stablecoin, also present potential roadblocks.

Nonetheless, Garlinghouse’s focus on liquidity infrastructure, not just transaction speed, sets Ripple apart from other players in the blockchain-based financial space.

Final Thoughts

Ripple’s plan to capture 14% of SWIFT’s global transaction volume by 2030 could represent a seismic shift in the way cross-border payments are conducted. With XRP already gaining ground in institutional adoption and the Ripple market expanding, the conditions for a breakout may be aligning.

Whether or not XRP reaches the lofty price targets of $100 or more, its strategic role as a liquidity enabler in the evolving financial ecosystem continues to solidify. As traders watch key resistance zones and potential ETF catalysts, XRP’s path forward may define the next chapter in global payments innovation.

2 months ago

22

2 months ago

22

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·