This development comes at a time when the XRP price is hovering near key support levels and facing volatile market conditions.

Ripple-SEC Settlement Aims to End $125M XRP Dispute

According to a court filing dated June 12, 2025, Ripple and the SEC have jointly requested Judge Analisa Torres to approve a proposal to dissolve the injunction on Ripple and modify the Final Judgment issued in August 2024. The joint motion also seeks the release of $125 million currently held in escrow—a penalty amount originally imposed for Ripple’s institutional sales of XRP, deemed to have violated securities laws.

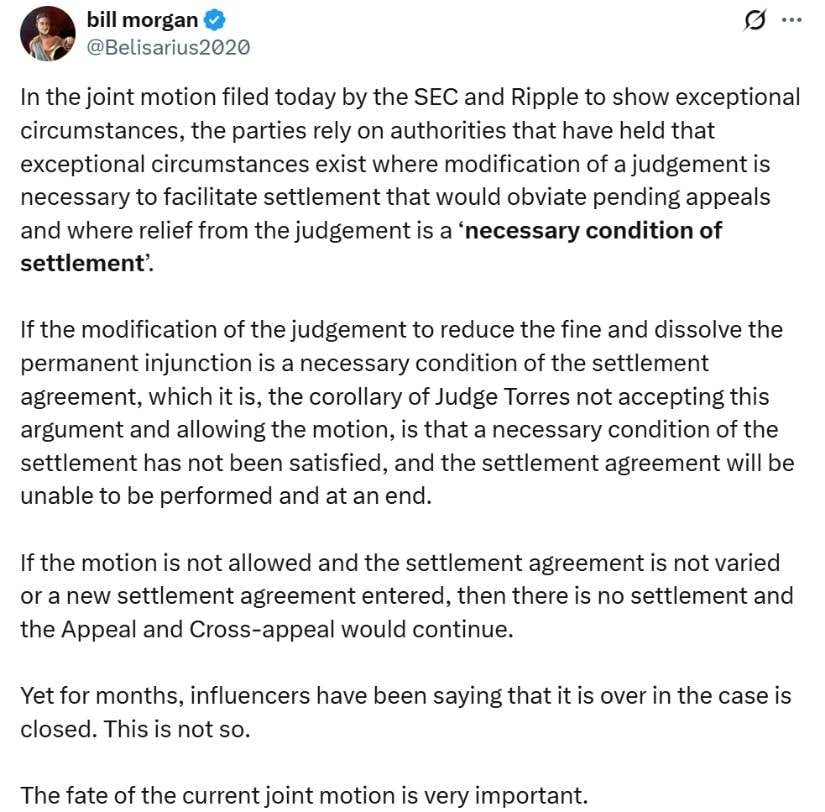

The Ripple-SEC settlement hinges on Judge Torres approving the joint motion—without it, the deal collapses and appeals resume. Source: Bill Morgan via X

Under the proposed terms, Ripple would pay $50 million to the SEC, with the remaining $75 million returned to the company. If accepted, this settlement would formally conclude one of the most consequential lawsuits in crypto history.

The XRP lawsuit began in December 2020, when the SEC alleged that Ripple had engaged in unregistered securities offerings. After years of courtroom battles, Judge Torres ruled in July 2023 that while institutional sales of XRP were securities, programmatic sales to retail buyers were not—setting a partial precedent in the digital asset space.

Legal analyst Bill Morgan emphasized the importance of the court’s response: “If Judge Torres does not accept the justification, the entire settlement falls apart,” he warned, pointing to the fragile nature of the proposed agreement. The motion cites precedents like Microsoft v. Baker and Major League Baseball to argue that judgment modification is warranted under “exceptional circumstances.”

XRP Price Holds Steady Amid Legal Optimism

As legal proceedings edge toward closure, XRP is trading around $2.13, having dipped by nearly 5% over the last 24 hours. The decline was largely influenced by broader market volatility following geopolitical tensions, including an Israeli airstrike on Iranian nuclear sites that sent shockwaves through global crypto markets. The overall crypto market cap dropped 4% in response.

XRP was trading at around $2.14 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

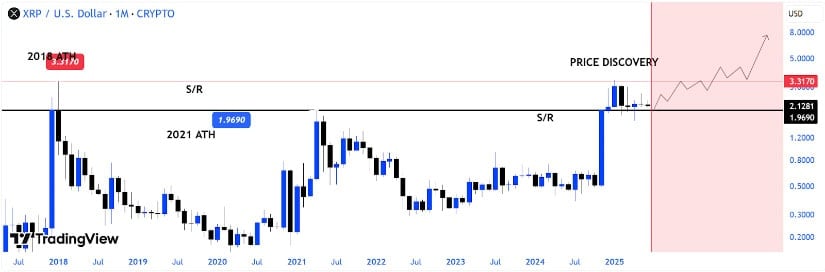

Despite the turbulence, XRP has shown resilience. The current key resistance lies between $2.34 and $2.35—a zone that has previously rejected upward movement. If bulls manage to break this barrier, analysts see potential for the Ripple currency price to reach $2.44 or even $2.60 in the coming sessions. On the downside, immediate support is observed at $2.10, with stronger backing near $2.05.

According to market watchers, XRP may be forming a five-wave bullish structure that began in April. This technical setup often signals the early stages of a more extended rally, lending support to a bullish XRP price prediction. “As long as XRP stays above the $2.11 threshold, the structure remains intact,” one analyst noted.

XRP Lawsuit Update: Broader Market Implications

A favorable resolution to the Ripple lawsuit could have far-reaching implications. For Ripple, the removal of the injunction would ease regulatory constraints, potentially reopening doors for institutional partnerships, including rumored collaborations with financial giants like Ripple Bank of America.

XRP lawyer Bill Morgan expects Judge Torres to approve the joint motion, moving the Ripple vs. SEC case closer to resolution. Source: @Web3Oraclez via X

From a market perspective, closure of the case could strengthen confidence in Ripple crypto and increase adoption of the Ripple ledger. It may also positively impact the Ripple exchange ecosystem by lifting the legal cloud that has loomed over the project for years.

The SEC, now led by Chair Paul Atkins, appears to be shifting from aggressive litigation to more pragmatic regulatory approaches. Accepting a reduced penalty not only allows for faster fund recovery but also helps preserve the agency’s credibility in light of previous rulings.

What’s Next for XRP Value and Ripple Market Momentum?

Much hinges on Judge Torres’ response. If the joint motion is approved, Ripple can focus on expanding its network and technological footprint without legal encumbrance. Analysts believe that such clarity could fuel a sustained rally in XRP price, potentially pushing it beyond the $3 mark—especially if overall crypto sentiment improves.

XRP’s accumulation near its all-time high, combined with the Ripple-SEC joint motion filing, could trigger a bullish rally beyond $3. Source: EtherNasyonal on TradingView

However, a rejection would mean prolonged appeals and continued uncertainty. That could delay not only price recovery but also Ripple’s broader ambitions in the blockchain finance sector.

For now, all eyes remain on the Southern District of New York. As Ripple XRP news dominates the headlines once again, both investors and regulators are watching closely—aware that the outcome of this case could set a precedent for how digital assets are treated under U.S. law.

Final Thoughts

The Ripple-SEC joint motion represents a rare moment of consensus in a legal battle that has defined the regulatory landscape for crypto. If approved, it could clear the path for Ripple to re-establish its presence in the global financial system—and give XRP the momentum it needs to reclaim and surpass key price levels.

16 hours ago

3

16 hours ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·