Meanwhile, XRP holders are closely watching the SEC’s next move in the ongoing legal saga, with ETF decisions poised to reshape the Ripple market.

Brad Garlinghouse Touts Institutional Momentum for Ripple XRP

In a recent episode of Ripple’s “Crypto in One Minute,” CEO Brad Garlinghouse underscored the transformative role of crypto ETFs in opening Wall Street to digital assets. He described ETFs as “the gateway to financial power,” offering institutions a secure and regulated path into crypto markets.

Institutional access to crypto is rapidly advancing, marked by the recent launch of XRP futures and ETFs on major platforms like CME and Nasdaq. Source: Brad Garlinghouse via X

“This was really the first time you had institutions be able to go on Wall Street and trade directly in crypto,” Garlinghouse noted, referring to the debut of XRP futures ETFs on Nasdaq and the Chicago Mercantile Exchange (CME).

The launch of Volatility Shares’ XRP Futures ETF ($XRPI), along with Teucrium’s earlier leveraged 2x XRP ETF, signals growing institutional demand for exposure to Ripple crypto products. These ETFs invest primarily in XRP-linked futures contracts, indirectly tying them to the Ripple ledger while bypassing traditional custody hurdles.

Garlinghouse believes this shift signifies a broader institutional acceptance of digital assets. “Crypto ETFs are institutionalizing this industry,” he said, adding that products like these are beginning to carry the same legitimacy as gold ETFs did in their early days.

XRP Spot ETF Decisions Loom Amid Legal Cloud

While institutional tools are expanding, regulatory clarity remains elusive. Several XRP spot ETF applications—filed by Bitwise, Grayscale, Franklin Templeton, and 21Shares—are currently under SEC review. The first key decision deadline is June 17, 2025, for Franklin Templeton’s application. However, Bloomberg ETF analyst James Seyffart predicts that formal approvals may not arrive until Q4 2025.

The SEC has postponed its decision on the 21Shares Spot XRP ETF until October. Source: BALE via X

Despite the delays, optimism is rising. According to Polymarket, the odds of the SEC approving a Ripple XRP spot ETF by the end of 2025 now stand at 83%. Analysts argue that spot ETF approval could drive significant XRP price gains, similar to Bitcoin’s 131% rally following BTC-spot ETF launches.

But progress may hinge on a resolution to the Ripple lawsuit. The SEC’s request to lift the injunction on institutional XRP sales and reduce the $125 million penalty was recently denied by Judge Analisa Torres. Former SEC attorney Marc Fagel clarified that no official settlement has been approved yet, despite rumors. “The court indicated it would not simply do what the parties asked without further briefing,” Fagel explained.

Legal Uncertainty Keeps XRP Traders on Edge

XRP has seen significant volatility tied to the Ripple lawsuit and SEC ripple case developments. The token rebounded 1.44% on May 24, following a 5.57% drop the day before. Traders are cautiously optimistic, but legal delays continue to weigh on sentiment.

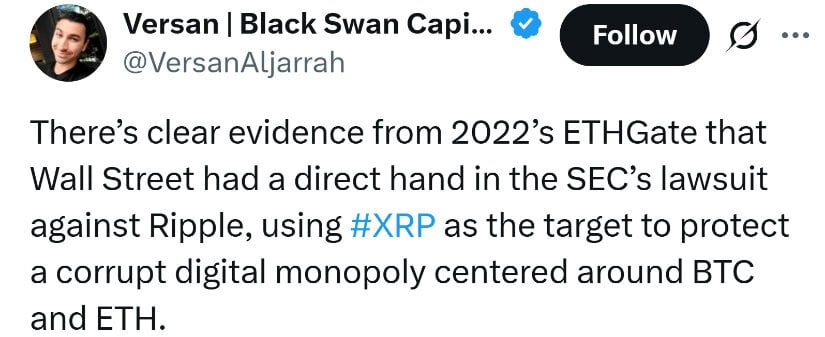

Evidence from 2022’s ETHGate suggests Wall Street influenced the SEC’s lawsuit against Ripple to safeguard a BTC and ETH-dominated digital monopoly. Source: Version via X

Pro-crypto lawyer Bill Morgan noted that the path to revising penalties and dissolving the injunction will be a high bar. “It is not just that the parties tried to avoid the correct rule,” he said, “but the very high bar to satisfy under the correct rule—showing exceptional circumstances.”

Garlinghouse, however, remains focused on positioning Ripple as a compliant institutional partner. Ripple’s new stablecoin, RLUSD, was launched to support regulated enterprise finance. Designed to maintain a 1:1 peg with the U.S. dollar, RLUSD is set to become a cornerstone of Ripple’s strategy in stable assets.

Ripple’s Vision: Bridging Traditional Finance and Blockchain

Garlinghouse believes that RLUSD and ETFs are part of a broader strategy to bring digital assets into traditional finance. “Regulatory alignment will be a core driver of institutional adoption,” he emphasized. By launching tools like RLUSD and supporting the XRP ETF wave, Ripple is moving beyond legal battles to build long-term trust with banks and financial institutions.

RippleNet already serves over 300 global partners, and the company is leveraging its network to push forward the adoption of Ripple currency price solutions. The broader Ripple exchange ecosystem is also expected to benefit from increasing institutional flow, especially as ETFs channel fresh capital into digital assets.

Ripple’s efforts also earned recognition from prominent industry figures. Attorney John Deaton recently stated that Garlinghouse could be a strong candidate for a hypothetical crypto Mount Rushmore, citing his leadership and innovation in launching RLUSD and acquiring institutional-grade platforms like Hidden Road.

XRP Price Prediction: Can It Break Through?

Market analysts are watching closely for two major catalysts: the SEC’s ETF decisions and the final outcome of the Ripple lawsuit. A positive resolution on both fronts could trigger a rally that pushes XRP value toward its all-time high of $3.55—and potentially higher.

XRP was trading at around $2.29, down 2.31% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

With institutional interest rising, the launch of ETFs, and Ripple’s expanding product suite, the XRP price prediction landscape is starting to look increasingly bullish. Should the legal hurdles clear and ETF approvals follow, XRP could eye the $4–$5 range in the medium term.

For now, XRP traders remain cautiously optimistic, awaiting clearer signals from regulators and the courts. But if Ripple’s vision plays out as Garlinghouse expects, 2025 may be the year Ripple XRP news dominates the conversation in both crypto and traditional finance.

4 hours ago

3

4 hours ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·