Ripple’s RLUSD stablecoin, now officially approved by the Dubai Financial Services Authority (DFSA) for use in the Dubai International Financial Centre (DIFC), has reignited momentum around XRP price predictions and long-term growth potential. Yet, despite the price jump and expanding use cases, data reveals a noticeable slowdown in XRP Ledger activity.

Ripple’s RLUSD Gets Regulatory Green Light in Dubai

In a significant boost to Ripple XRP news, the company’s U.S. dollar-pegged stablecoin, RLUSD, received regulatory approval for institutional use in the DIFC. Backed by liquid reserves and supervised by both the DFSA and the New York Department of Financial Services (NYDFS), RLUSD is positioned as a compliant solution tailored to global institutions.

Ripple has received regulatory approval to operate its RLUSD stablecoin within the United Arab Emirates. Source: Mr. Man via X

“This approval will accelerate our expansion across strategic markets,” Ripple said in a statement, emphasizing that RLUSD is built for utility, not retail speculation. The approval aligns with Ripple’s broader regulatory strategy amid ongoing developments in the XRP lawsuit with the U.S. Securities and Exchange Commission (SEC Ripple case).

XRP Price Rises on Institutional Endorsements

Buoyed by the regulatory win, XRP price briefly surged this week, as investors and traders interpreted Dubai’s endorsement as validation of Ripple’s long-term viability. Beyond price speculation, tangible support has come from corporate players.

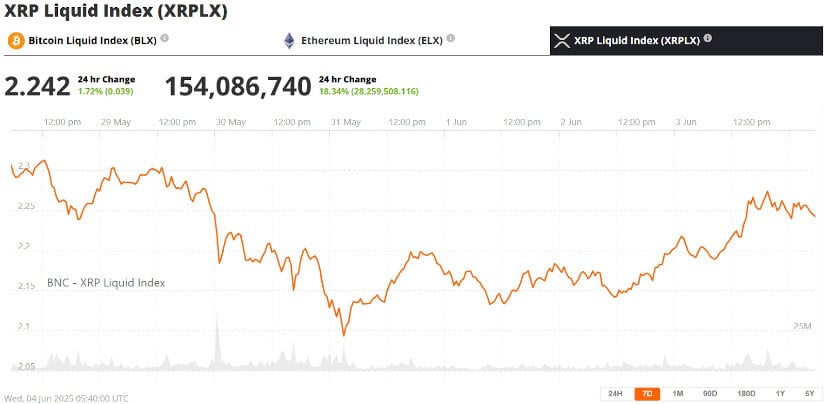

Ripple (XRP) was trading at around $2.24, up 1.72% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

VivoPower, a NASDAQ-listed renewable energy firm, announced a $121 million XRP-based treasury strategy, while China’s Webus International plans to allocate $300 million toward XRP reserves. In another major development, Germany’s DZ Bank, managing over €350 billion in assets, has adopted Ripple’s custody platform, marking one of the largest endorsements yet in Europe.

These moves signal growing confidence in Ripple crypto as a trusted settlement and value transfer mechanism. Industry experts see this as a foundational shift.

“Institutions aren’t just buying the asset—they’re integrating the infrastructure,” said one Ripple advisor familiar with the matter.

XRP Ledger Activity Declines Despite Positive Sentiment

However, not all indicators are flashing green. According to XRPScan, XRP Ledger payments have dropped sharply to just over 320,000 transactions—the lowest recorded since October. Active wallet addresses have also fallen below 10,000, accompanied by a significant drop in XRP burned as transaction fees.

XRP Ledger Payments chart. Source: XRPSCAN

This is a notable cooldown from Q1’s performance, where the ledger saw a 36% quarter-on-quarter rise in payments and a 142% surge in active addresses, based on Messari data. The decline suggests a lull in retail engagement or a pivot toward larger but less frequent institutional movements.

Despite the dip in activity, analysts remain optimistic, pointing to upcoming events like XRP Ledger Apex 2025, which will be hosted in Singapore from June 10–12. More partnerships or product announcements could revitalize usage levels.

XRP Struggles to Keep Pace With Bitcoin

While Bitcoin has reached new all-time highs above $110,000, XRP has not mirrored its earlier outperformance. After rising from $1.60 to $2.60—a 62% gain—Ripple price has since plateaued, well below its January high near $3.40.

This divergence has raised concerns among some traders. “It shows that XRP value isn’t tracking broader market sentiment like it used to,” one market analyst noted. “There’s a shift in narrative, possibly due to macro risk or fatigue from the drawn-out XRP SEC lawsuits.”

XRP Price Prediction and Market Outlook

Looking ahead, analysts remain divided on short-term movement. Some forecasts suggest XRP could revisit $3 in the near term, especially if Dubai’s approval attracts further institutional liquidity. Others are cautious, pointing to weakened on-chain metrics as a possible red flag.

XRP is showing early signs of bullish momentum with increasing volume, though a clear trend has yet to be confirmed. Source: Mindfullylost on TradingView

Nevertheless, the broader Ripple market outlook appears intact, especially as Ripple continues to gain regulatory clarity in key jurisdictions. The Ripple lawsuit update and the firm’s growing alignment with banking giants like Ripple Bank of America reinforce the notion that XRP is evolving into a utility-focused asset with institutional backing.

Final Thoughts

The recent approval of RLUSD in Dubai is a clear win for Ripple, helping to reinforce XRP’s position as a regulated, enterprise-grade crypto asset. Yet, the simultaneous dip in ledger activity reveals a more nuanced picture—one where growth is coming from institutions, but retail and decentralized engagement may need renewed momentum.

With Ripple’s next big conference on the horizon and the SEC Ripple case still unfolding, the coming weeks could define XRP’s trajectory for the rest of 2025.

Stay tuned for more XRP news and the latest on the Ripple lawsuit as developments continue to shape the future of this high-profile digital asset.

2 weeks ago

6

2 weeks ago

6

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·