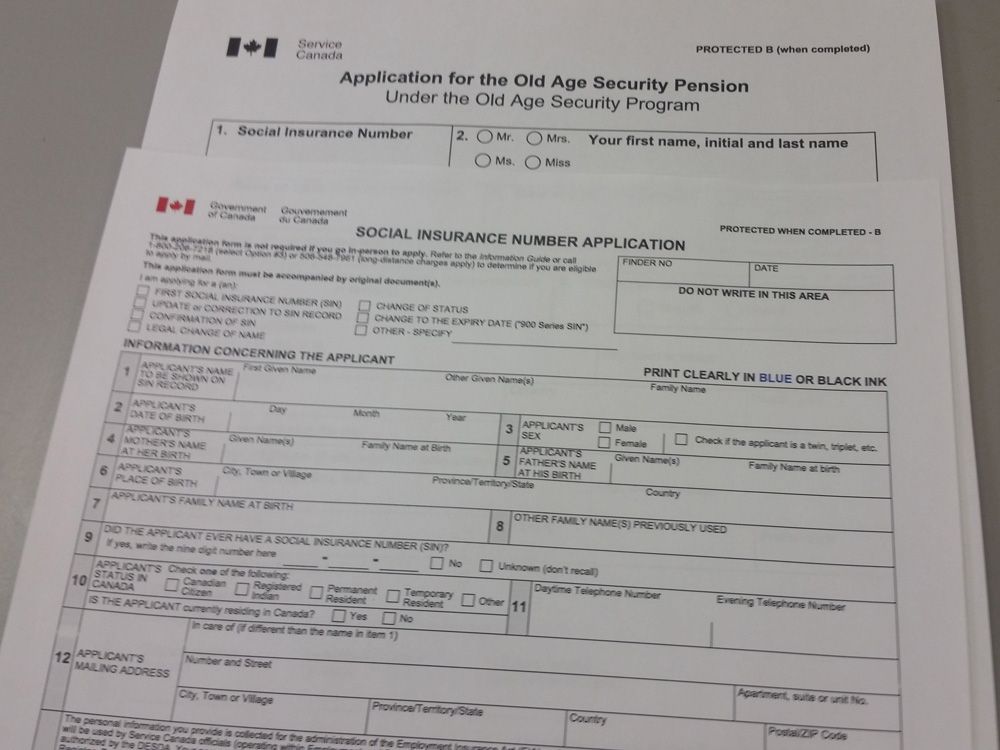

For seniors, government pension plans are a top priority as Canadians live longer and workplace pensions become a rarity and no program is causing more anxiety than

Old Age Security

.

For seniors, government pension plans are a top priority as Canadians live longer and workplace pensions become a rarity and no program is causing more anxiety than

Old Age Security

.

Old Age Security (OAS) offers seniors a maximum of $727.67 per month for Canadians aged 65 to 74, with maximum monthly payouts jumping to $800.44 per month at age 75.

The program has been beneficial for seniors looking to retire. A recent survey from Bloom Finance shows that 61 per cent of Canadian seniors rely on OAS and the Guaranteed Income Supplement (GIS) as their main source of income in retirement, while 46 per cent of respondents called it their most helpful relief measure in retirement.

Despite the success of the OAS retirement subsidy for seniors, there remains angst when it comes to its future.

The Canadian Association of Retired Persons called the pension plan a “lifeline under threat” earlier this month as governments might consider changes to cut costs to pay for spending promises on defence and housing.

“It is the first place the government will look for savings — threatening Canadian seniors’ ability to live with dignity in retirement,” CARP wrote in a statement.

“OAS is more than a monthly cheque. It’s a promise — a promise that Canada will protect its older adults from poverty and neglect. CARP is demanding that this promise be kept.”

In 2012, a report from the parliamentary budget officer (PBO) found that OAS benefits are sustainable in the long term without any additional taxpayer help, but some are still calling for changes to the payments.

In October, Ben Eisen, a senior fellow with the Fraser Institute, suggested a more targeted approach for seniors who struggle financially. He also proposed increasing the minimum age to 67.

“Spraying almost the entire demographic with a firehose of scarce taxpayer funds is difficult to justify on equity grounds,” he wrote in a report.

“Any increase to OAS benefits would be deficit-financed and the cost would fall on the shoulders of working-age Canadians who must pay the interest on the resulting debt.”

Eisen also notes that by 2022, 16 of the 22 high-income Organization for Economic Co-operation and Development (OECD) nations had already made similar changes or were considering those changes.

The federal government has already tried Eisen’s idea. In 2012, the Harper government announced it would increase the minimum age requirement for OAS payments from 65 to 67, a move that was quickly reversed in 2016 under the Trudeau government.

Conservative leader Pierre Poilievre , who voted in favour of Harper’s motion in 2012, is now looking to court the senior vote and has promised to maintain the status quo when it comes to OAS.

He has also pledged higher thresholds for tax-free income among seniors and allowing seniors to contribute to their RRSPs until age 73, up from 71.

“These are welcome wins for seniors,” Anthony Quinn, CARP COO, said in a report. “It’s the first sign we’ve had in this campaign that the parties are listening to CARP and talking to seniors.”

In 2022, the Liberals increased OAS payments by 10 per cent for Canadians over the age of 75, but voted against a $16-billion bill from Bloc Québécois that would’ve made the same increase for those under the age of 75. The bill also had the support of the Conservatives and NDP.

The Liberals have promised changes to the GIS and the Registered Retirement Income Fund meant to help seniors, but have yet to mention their plan for the OAS.

Leaders pitch financial incentives to boost the skilled trades Why energy producers are lukewarm on ‘energy superpower’ planThe NDP, meanwhile, are promising to boost all seniors out of poverty through the GIS.

Latest promises

The Liberals are promising $15,000 for mid-career workers in priority sectors to learn new skills needed for a changing workforce. The NDP is promising to maintain the federal capital gains tax rate and reinvest the money on universal pharmacare, rent control and grocery price caps. The Conservatives are promising to crack down on scammers by forcing mandatory scam detection systems on banks and telecoms, a 24-hour delay on high-risk transaction on seniors’ accounts, and targeting executives who allow scams to continue.Election headlines

What you need to know about the Liberals’ promise to make Canada a ‘leading energy superpower’ Jason Heath: What the federal election platforms could mean for your pocketbook Carney proposes to speed up military spending, change defence-procurement strategy• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·