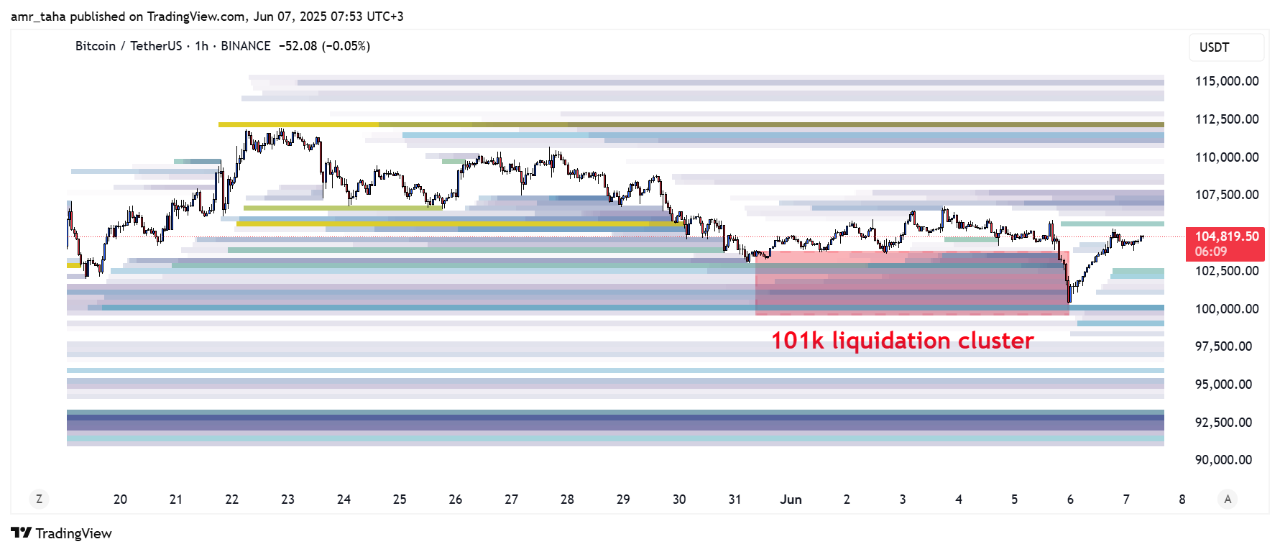

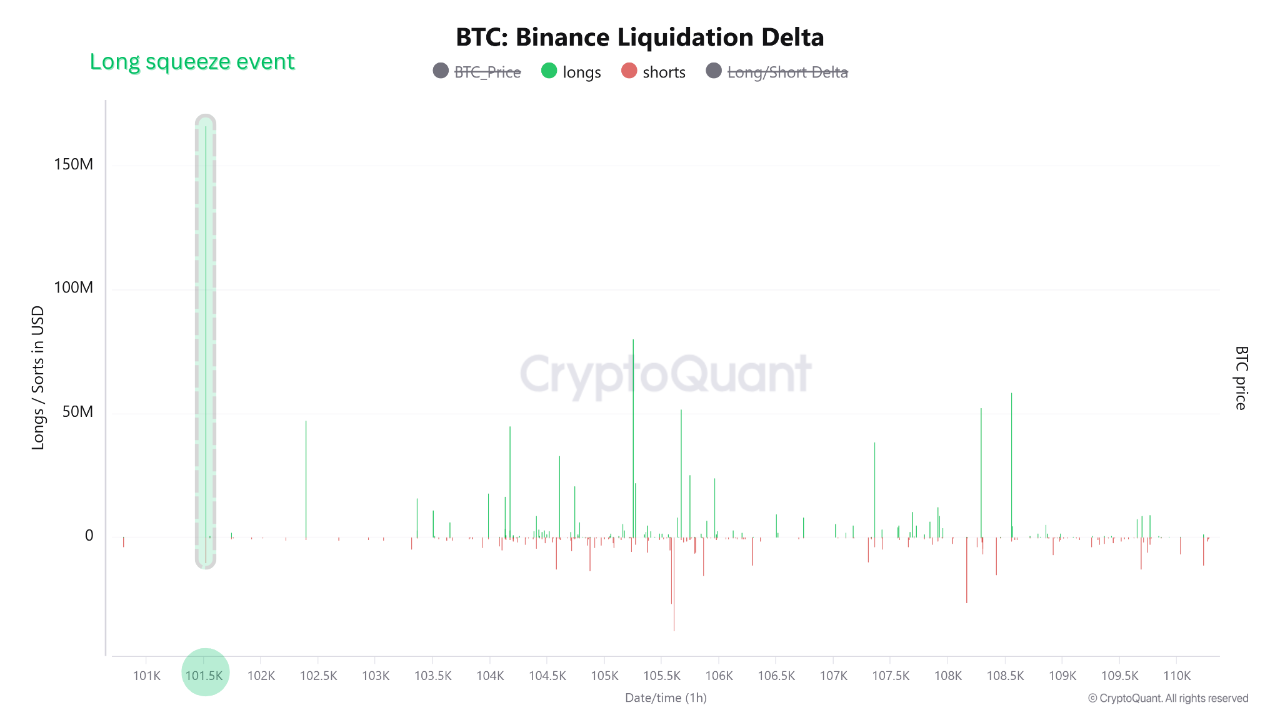

$160M Liquidation Squeeze Hits Binance at $101K

Bitcoin experienced a sharp long liquidation cascade on Binance, where over $160 million in leveraged long positions were wiped out as BTC briefly dipped below the $101,000 level. According to the report this cluster of liquidations caused short-term volatility but may have created an opportunity for longer-term market participants.

These events often mark local capitulations, which historically have preceded accumulation phases and eventual price rebounds.

Binance Sees Over 4,000 BTC in Outflows

In response to the sell-off, Binance recorded over 4,000 BTC in withdrawals, signaling that investors may be pulling funds off exchanges in anticipation of future upside or to safeguard assets from further volatility.

Notably, the last major deposit spike occurred on May 22, and since then, outflows have consistently outweighed inflows — reinforcing the thesis of growing accumulation.

LTH Realized Cap Breaks $37 Billion

While short-term traders took heavy losses, long-term holders (LTHs) showed remarkable resilience. The report highlights that the LTH Realized Cap — an on-chain metric reflecting the capital basis of long-term coins — has surpassed $37 billion, reaching its highest level since June 2023.

This divergence between STH (short-term holder) volatility and LTH accumulation points to a structural reset in the market.

Outlook: Volatility Now, Strength Later?

CryptoQuant’s data underlines three key takeaways:

Leverage Reset – The long squeeze at $101K has cleared overleveraged positions. Supply Shock – Sustained BTC outflows from Binance indicate long-term accumulation. Structural Resilience – LTHs continue to gain conviction amid short-term noise.While retail investors may be rattled by price whipsaws, these on-chain shifts suggest Bitcoin is entering a healthier phase — one marked by reduced leverage, strong hand accumulation, and potential for more stable growth.

The post Smart Money Moves In After $160M BTC Crash—Is a Rally Coming? appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·