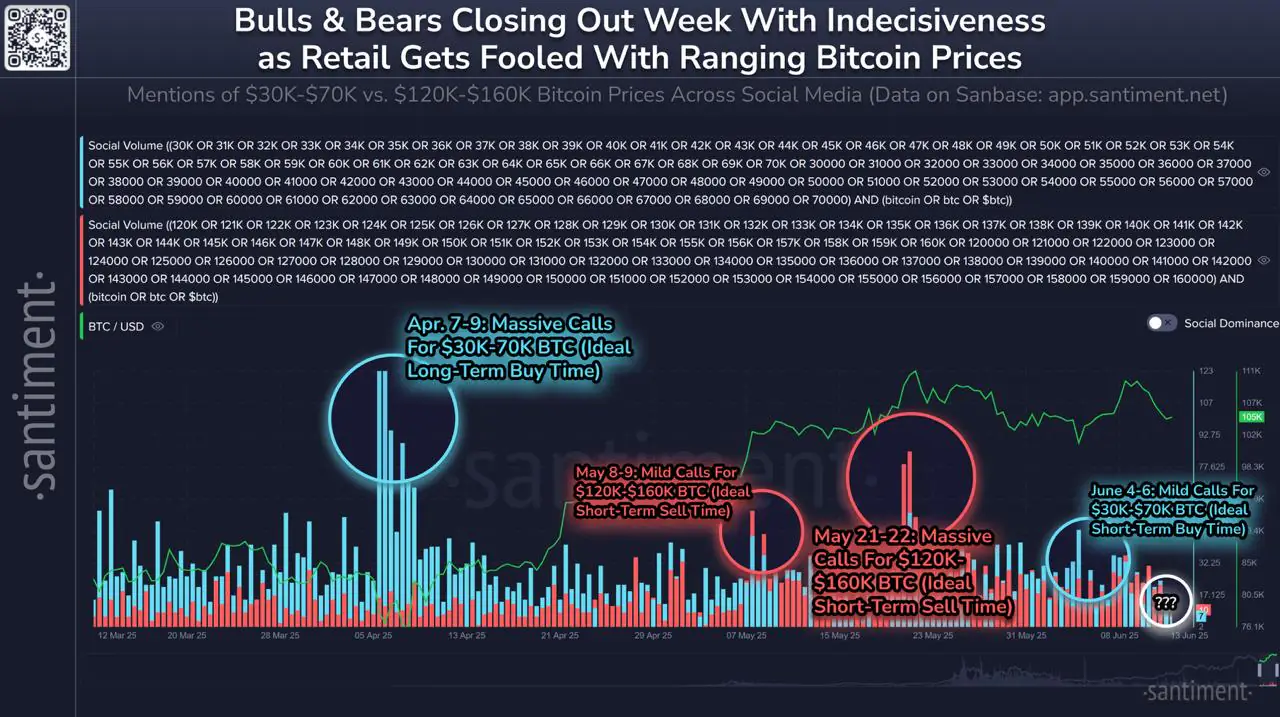

In a recent chart shared by the platform, Santiment tracked the volume of Bitcoin price predictions posted across social platforms like X, Reddit, Telegram, 4Chan, BitcoinTalk, and Farcaster.

The chart categorizes retail calls into two sentiment ranges:

Blue- Mentions predicting Bitcoin between $30K–$70K Red- Mentions predicting Bitcoin between $120K–$160K

Interestingly, during the past three months, Bitcoin has not traded below $70,000, nor has it exceeded its all-time high of $112,000. Despite this, retail discussions frequently swung toward extremes—either panic-selling levels or euphoric targets.

According to Santiment data, these sentiment swings offer a reliable counter-trading opportunity. When retail sentiment leans heavily toward bearish or overly bullish predictions, markets often move in the opposite direction.

A key example was observed between June 4 and June 6, when Bitcoin dropped to $101,000. As retail panic surged and traders began forecasting further declines, whales began accumulating. The resulting shift triggered a swift recovery, highlighting the effectiveness of tracking sentiment extremes.

“At this moment, retail sentiment appears mixed,” Santiment noted. “Traders are waiting for a big move to jump in, which may once again present a contrarian opportunity for professionals watching from the sidelines.”

The firm emphasizes that counter-trading the crowd remains one of the most consistent strategies—not by relying on price charts alone, but by observing the emotional tides of retail traders in real time.

The post Santiment Reveals the Bitcoin Indicator That Outsmarts Support and Resistance appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·