Home and Blog Update

Join me in reflecting on October 2025, a month marked by winter preparations, garlic planting, and careful financial decisions.

I think October 2025 went down in the books as laid-back as I spent my laughable spare time tidying up for winter.

Near the end of October, I planted the garlic for next spring, when I will harvest around 300 bulbs.

Most of our higher expenses went to extended healthcare, which covered physiotherapy for Mrs. CBB and me, as well as speech therapy for our son.

Since it’s near the end of the year, my benefits have been used in full on our son for speech therapy $4500, so now we pay out of pocket.

We also found Amazon resale and spent more than we should have on items we will use.

The prices were incredibly low, so we took advantage of them.

I also bought oil and filters on sale at Canadian Tire for my truck so I could do an oil change (darn, I need to book Krown).

Overall, I think we had a decent month with our net income and investment increases, but like always, we know we are aggressive investors and anything could happen.

What kind of risk-tolerant investor are you? Conservative, Moderate (or Balanced), and Aggressive. Comment below.

Blog Update

The blog has been doing a bit better, mostly due to Thanksgiving recipe searches, debt, and budgeting, since it’s closer to the end of the year.

I have a few things up my sleeve for 2026 but I need to get my butt in gear to start everything in motion.

I would like to thank all of you for sharing, liking, and commenting on my blog posts.

It means a lot to me, as it’s nice to know that people are reading and gaining value from what I have to say.

Additionally, I always appreciate hearing from everyone.

Get Your Monthly Budget Evaluated By Mr. CBB

Lastly, for 2026, I’d like to put out a feeler to see if anyone is interested in my evaluating their monthly budget and offering suggestions.

If that’s something you’re interested in and are okay with me blogging about it, then message me.

You will need to give me all of your income and debt information although you do not need to give me your name or I don’t have to include it in the blog post.

The choice is entirely up to you. I’m also leaning more towards someone who already budgets and has at least 3 months of budgets that i can review.

That’s all for now, CBB Friends,

Enjoy our October 2025 Family Budget update.

Mr. CBB

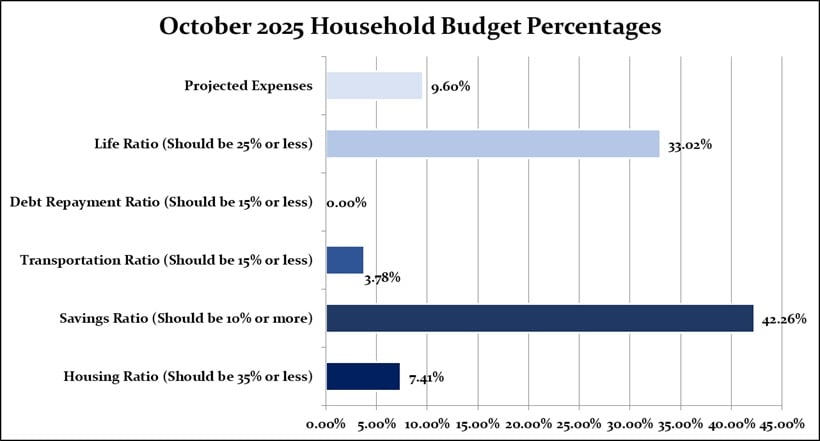

October 2025 Home Budget Household Percentages

October 2025 Household Percentages

October 2025 Household Percentages

Savings of 42.26% include investments and savings based on our net income, which was decent. Mind you, Mrs. CBB had 3 pay cheques, so that helped increase the net savings.

Our life ratio is 33.02%, which includes all variable expenses, such as groceries, entertainment, miscellaneous items, health/beauty products, clothing, and more.

Again, we are struggling in the groceries, health, and beauty categories. Unfortunately, this year has been tough.

Some of you might say that we should spend what we have budgeted, and we should, but we aren’t. We discussed this, and for 2026, we will make a better effort to stick to the budget.

When you become debt-free, it’s harder to say no than it is to say, I can’t because there is no money.

Transportation is covered at 3.78%, which includes our vehicle’s gas, insurance, and maintenance, and we hold no debt.

I keep the two spare gas cans filled with petrol throughout the year, mainly for the snowblower, lawn mower, power washer, and weed wacker. In September, I did not fill up the truck with petrol.

Our house and vehicle are paid off with zero debt; however, we still pay property taxes and maintenance fees.

For our housing, we came in at 7.41% for October which covers property taxes and home maintenance.

The projected expenses of 9.60% can change based on what we encounter monthly, such as a new item we need to save for.

October 2025 Home Budget Estimation

Below are two tables: the October 2025 Home Budget and our Actual Home Budget.

October 2025 Monthly Budgeted Amount

October 2025 Monthly Budgeted Amount

We may not need all the money we budgeted for in each category; however, remember that the number is only an estimate based on the actual expenses from the previous year.

Don’t forget to budget for projected expenses, as your entire month can fail if you don’t plan accordingly.

Actual October 2025 Home Budget

October 2025 Monthly Actual Amount

October 2025 Monthly Actual Amount

Current Canadian Banks We Use

Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks. Emergency Savings Account– This money is in a high-interest savings account (HISA) High-Interest Savings Account (HISA)– This savings account holds our projected expenses.October 2025 Home Budget Year-To-Date

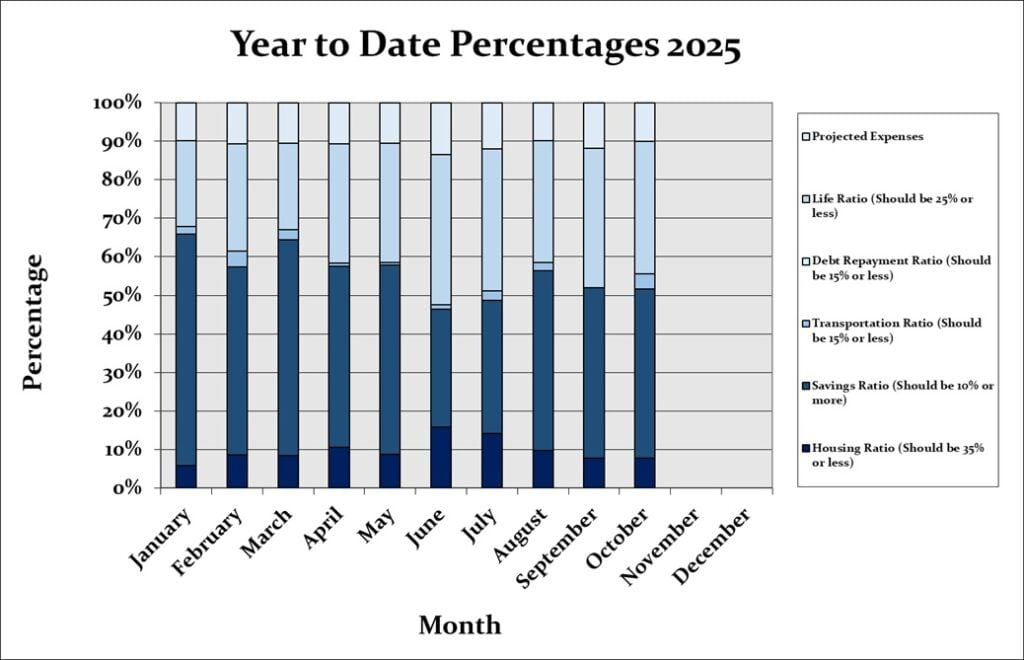

October 2025 Month by Month

October 2025 Month by Month

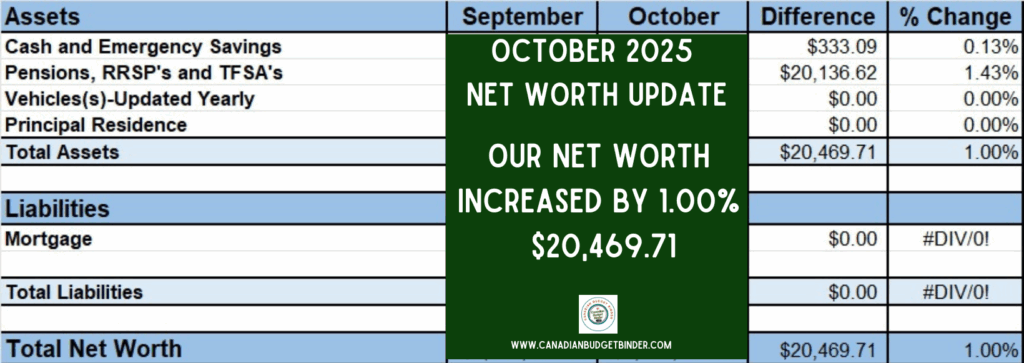

Our net worth increased by $20,469.71 in October, thanks to additional pay and investment gains, resulting in a 44.84% increase in our emergency fund savings opportunity through prudent spending.

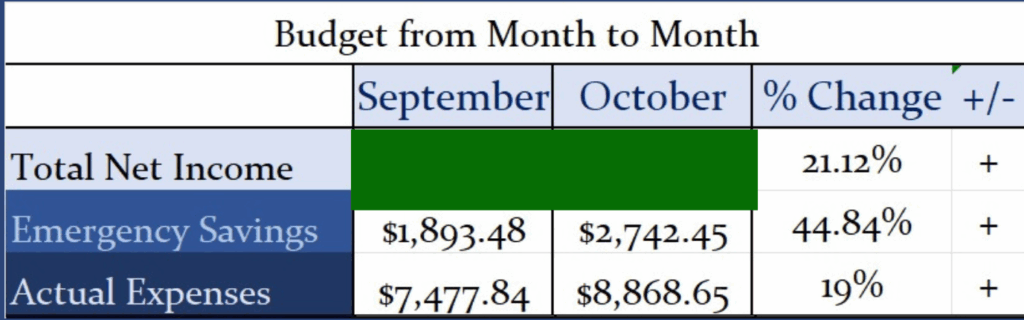

Month-to-Month Home Budget October 2025

Budget From Month to Month October 2025

Budget From Month to Month October 2025

Our emergency savings increased by 44.84%, meaning we saved more in October than we did in September.

Always expect to see changes from month to month, as that’s normal since money is being spent and, in some cases, more than anticipated.

Between September and October, we experienced a 19% increase in actual expenses, indicating that we spent more money than in the previous month.

Also, our net income in September decreased by 18.59% compared to August.

Breakdown- October 2025 Home Budget Categories

Below are some of our variable expenses from October 2025 that I will discuss.

Please let me know if you would like me to explain or include any additional information in the next budget update.

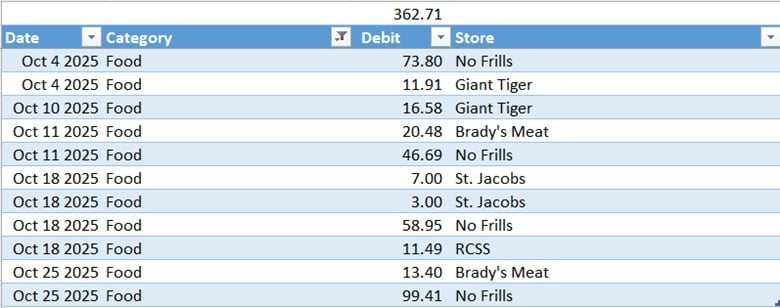

Grocery Expenses October

Grocery Shopping

Grocery Shopping

Please find all the online groceries we purchase in the CBB Amazon Storefront.

Our monthly grocery budget is $960, plus a $25 stockpile budget; we spent $1,332.20 in October.

We spent $372.20 over budget for the month.

Our current grocery overspend for 2025: $ 1,550.81 + $ 600.07 + $206.08 = $2,356.96 + $842.93 + $372.20= $3572.09/

Overage will be considered next year when we create our grocery budget.

With prices rising so much at the grocery store, it’s becoming challenging, as is our desire to find reduced products.

Our running total as of October 2025 is $13,605.98 for two adults and one child.

In 2024, our monthly grocery budget was $900, but with price increases, we calculated an additional $60 per month, totaling $720 per year.

I was reflecting on our grocery budget over the years, and in 2012, we were spending $190 monthly.

You do the math!

CBB Food Budget Challenge Update

We blew our grocery budget again in October, and below is where the $1300 worth of groceries went:

Blog Recipe Creations Resale on Amazon General groceries Flashfood purchases Shoppers Drug Mart 20x points (all deals and best prices only).Where We Grocery Shop

The two grocery stores we shop at most are Zehrs and Food Basics. Also, we buy grocery items from Amazon Canada and Flashfood.

On occasion, we visit Costco and Walmart as needed to buy in bulk or grab a good sale.

Check out my new post, where I explain how to find reduced-cost groceries on Amazon.

October 2025 Grocery Food Savings Jar

We have officially saved $2,195.05 this year, from Flashfood and coupons, which is fantastic, especially since we don’t typically use many coupons.

In 2024, we saved $1,712.87 by using coupons and purchasing reduced-price products at local grocery stores.

Throughout 2025, we plan to track our grocery food savings, which include the following;

Coupons Discounts Free Stuff (ex, using SCOP) Rewards Points redemptionIf you’d like a copy of the Grocery Savings Jar, you can find it on the Free Resources page.

In December 2024, I shared a blog post about our upcoming 2025 Food Budget Challenge and was looking for fans who wanted to join us.

I’d like to try this grocery budget challenge again in 2026. If you’re interested in participating by filling out the chart monthly and sending it my way, please reply to this email and let me know.

Grocery Food Savings Jar 2025 October

Grocery Food Savings Jar 2025 October

Our Flashfood Savings Last Year

For 2024, using the Flashfood App saved our family $992.60!

As of October 2025, the total amount saved in 2025 is $2,678 using Flashfood.

Combining the Flashfood savings with our grocery savings jar, we saved $2705.47 in 2024

I’ll tally it up again at the end of 2025 to see how much we save on groceries.

We continue to use Flashfood because it saves us a significant amount of money.

Please consider signing up using my affiliate code below.

Sign up for Free with FlashFood and earn a $5 Credit.

As you do, you’ll receive $5 free when you place your first order. It’s a win-win for both of us.

Every person who signs up gets a $5 credit, a freebie Flashfood offers for new app customers.

Also, Flashfood has added a small service fee to every order, which I find acceptable.

Use my referral code, MOCD28ZN4, for a $5 credit.

Your first purchase must be over $15.

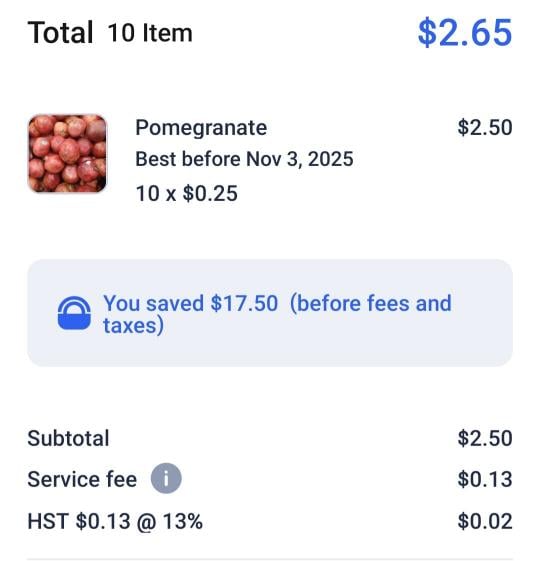

Flashfood Orders October 2025

We only had two Flashfood orders in October and both were fruit related.

It was hard to turn up pomegrante for $0.25 so we bought 10 of them and they were delicious.

We also decided to buy our first fruit box and as you can see from the photo below that was $5 well spent.

The mangos were sweet and although I’ve had bad luck with dragon fruit in Canada I hit jackpot in this produce box.

The dragon fruit was the best and sweetest I’ve ever tasted. I’m certainly going to be putting money towareds produce boxes in 2026.

In a way, they are like small gifts because you don’t really know what you are getting until you dig through the bag.

First Fruit Box

First Fruit Box

Flashfood October 2025 Fruit Box

Flashfood October 2025 Fruit Box

Flashfood October 2025 Pomegranate

Flashfood October 2025 Pomegranate

Pet Expenses

Two-Cats-Pets-Budget-Category

Two-Cats-Pets-Budget-Category

We’ve created a $350 monthly budget for our two cats, which we feed premium dry cat food and a higher-end wet cat food.

Our pet expenses for October 2025 totaled $504.62, exceeding our budget by $154.62.

Most of the pet expenses went to wet cat food, along with one bag of dry, all of which are premium.

I will have an update on our ginger cat and his allergy, as we believe we have identified the cause.

We purchased vitamins for the cats for about $25, which seem to be working as their coats are thick and shiny.

Additionally, we are now feeding a stray cat that comes to the porch every day for two cans of food.

We have tried to catch the cat to no avail, but are going to contact the Humane Society to see if we can get a trap.

It’s so cold outside, and this small cat must be freezing.

We are just happy that the cat chose us for help. I will keep you updated, but until then, we now have three cats, two indoor and one outdoor.

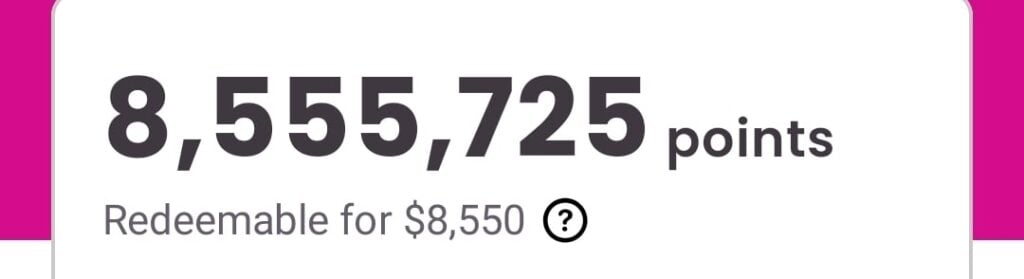

PC Optimum Rewards Points October 2025

PC Optimum Points October 2025

PC Optimum Points October 2025

Since 2018, we have earned over 9 million PC Optimum Points, equivalent to $ 9,000.

We started 2025 with under 7 million PC Optimum Points, and as of September, we have 8,555,725 and are working towards $9,000 by the end of 2025.

December is our last month to reach our 2025 goal, and I’m unsure if we will achieve it.

Last month, I asked if you thought it would be a good idea to use our points on groceries in 2026.

However, a new opportunity has arisen, which I will blog about to let you know how we will utilize our Shoppers Optimum Points.

How We Saved So Many PC Optimum Points

Below are blog posts for anyone interested in learning how we earn PC Optimum Points.

How To Earn PC Optimum Points Fast How We Earned 4 Million PC Optimum Points President’s Choice Financial World Elite Mastercard PC Insiders World Elite MastercardCanadian Tire Triangle Rewards Points

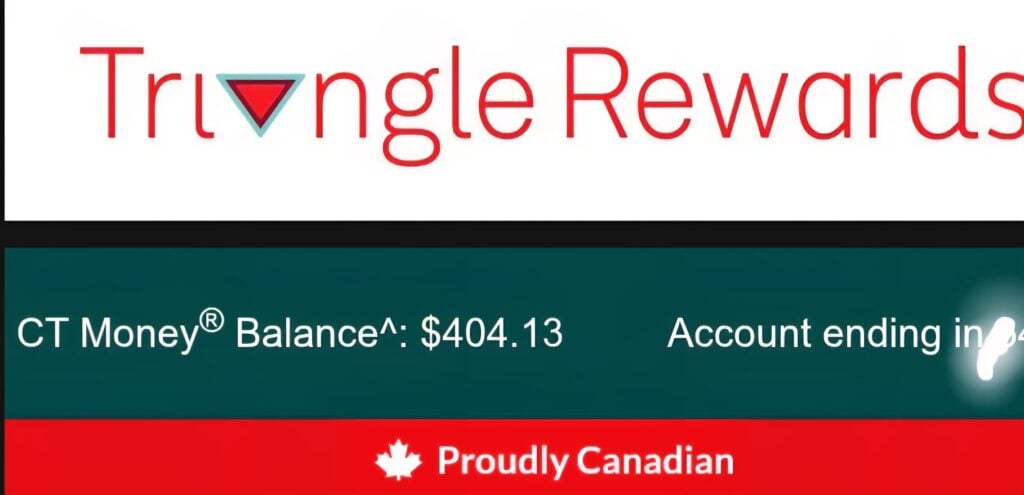

Triangle Rewards October 2025

Triangle Rewards October 2025

I know it looks like my Triangle Rewards are building again, and you’re right, they are.

I’ve been spending some money buying oil for the truck, and I also do my neighbour’s oil change.

She asked me to do a brake job for her, but I am waiting for her to give me the green light.

I try to buy as much as I can at Canadian Tire so I can earn rewards points.

Honestly, the points always get used at some point towards something for the house, garden, truck or our son.

I’ve said it before, and besides the PC Optimum Credit Card, the Canadian Tire MasterCard is my favourite for collecting rewards points.

What is your favourite rewards points credit card? Comment below.

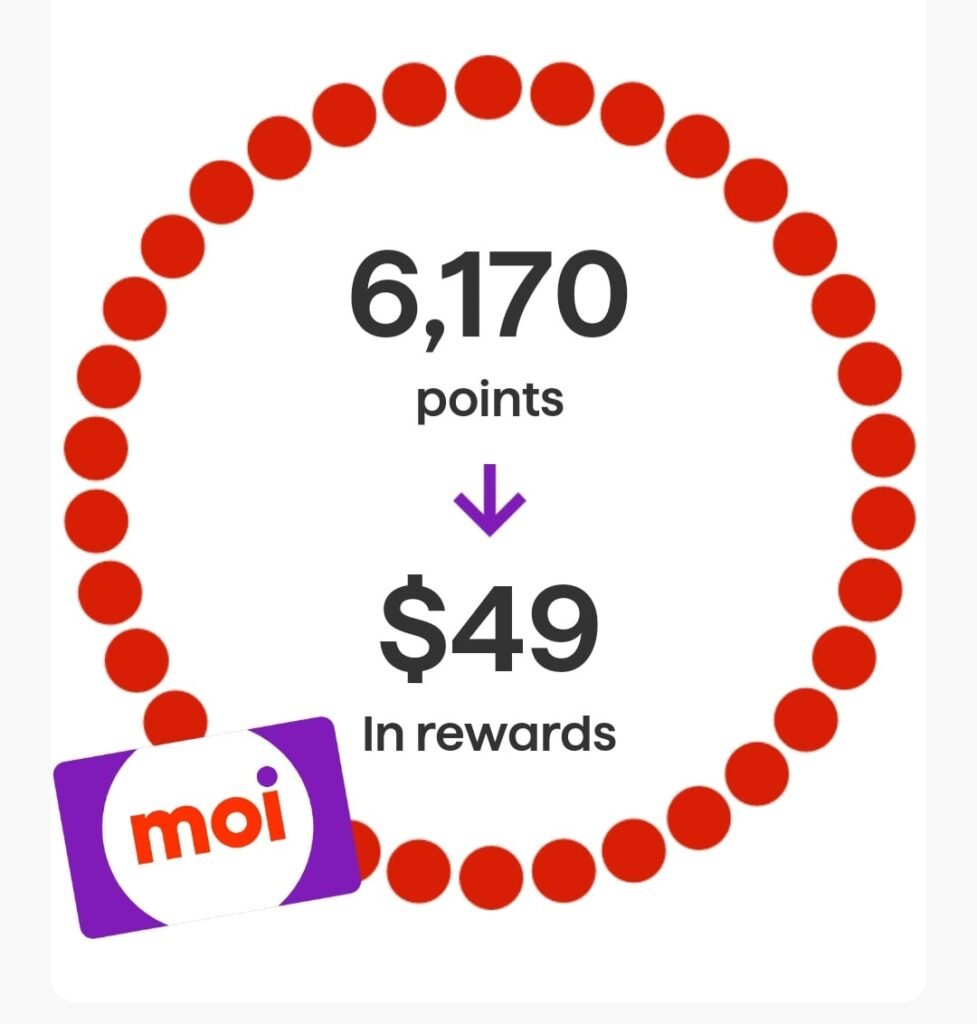

Moi App Rewards

Moi Rewards

Moi Rewards

For every 500 points earned, buying products with Moi points equals $4.

My Moi app review is in the works, and I think we’ve had enough experience to offer our feedback on the program.

Currently, we have $49 in Moi Points that we can redeem towards our groceries.

Compared to PC Optimum Points, we are slow to earn rewards, as we don’t often use the offers for which we get points.

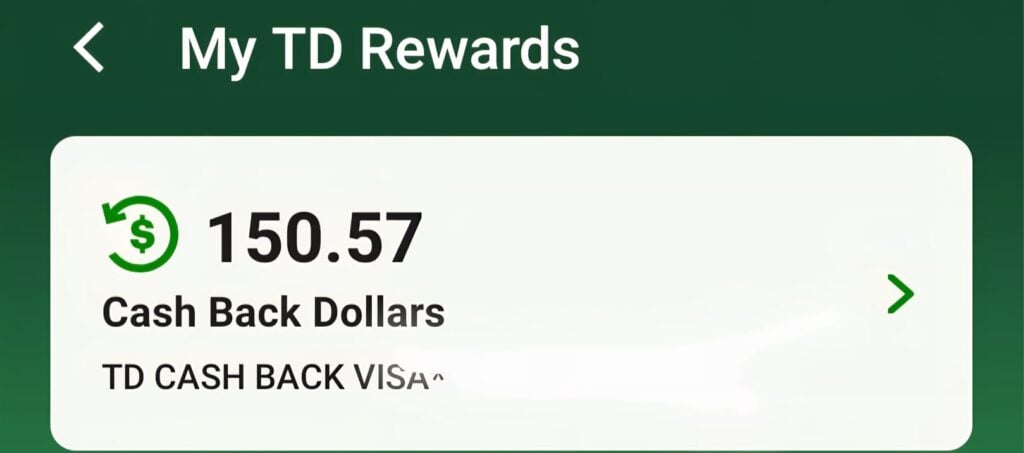

TD Rewards Credit Card October 2025

My TD Rewards October 2025

My TD Rewards October 2025

This TD Visa credit card is not the best for reward points, as it took us years to earn $500.

We use this account exclusively for online purchases from Amazon, PayPal, Shopify, and other similar platforms.

The credit card has a $5000 limit, although we initially started with $500.

What credit card do you use besides PC Mastercard that offers you amazing cashback?

Dream Air Miles Update

Air Miles Canadian Budget Binder 2025

Air Miles Canadian Budget Binder 2025

Most of the 4332 points are from our house and vehicle insurance, which offers Air Miles.

Eventually, I’ll get around to writing a review about Air Miles.

Do you find enough benefits in the program to use it?

I’d love your feedback, either by leaving a comment on this post or by emailing me at [email protected].

October 2025 CBB Net Worth Update

Net Worth Update October 2025

Net Worth Update October 2025

Overall CBB October 2025 Budget + Net Worth Update

I’ve had a few people email me about our mortgage and why it’s not included in the chart.

After purchasing our home in 2009, we paid it off by 2014, which was not easy, but we managed to do it.

Our 2025 market home value is approximately $988,000 to $1 million, and we purchased the home for $265,000 in 2009.

In October 2025, our net worth increased by $20.469.71, primarily due to increases in our investments.

Mrs. CBB, since she doesn’t work, last contributed money to her RRSP in 2009, and it was valued at around $47,000 after she lost money in the financial crash.

Today, it’s worth over 200k. That’s the power of time and why it’s so important to invest when you can, even if it’s something small.

I still have room to contribute to my 2025 RRSP, which I may top up come tax time, but I’ll wait and see what happens with the state of the Canadian economy.

2025 Food Challenger Updates

The 2025 Food Budget Challenge aims to determine whether participants can stick to their grocery budget and how much they can save in 2025.

Below is the last remaining Canadian Budget Binder fan who is participating in sharing their grocery budget and expenses with everyone for the year.

We started with four participants in January, and in less than four months, we have been reduced to one.

Budgeting requires a serious commitment, and what I’ve learned over the years from any challenge I’ve hosted is that almost all participants drop out.

On that note, if participant one finishes the year, she wins the challenge!

Let’s see if she can stick with the challenge and keep up with us.

Food Budget Challenger #1

CBB Grocery Challenge October 2025

CBB Grocery Challenge October 2025

Hi Mr. CBB,

I am feeding a family of 2 adults and live in Ontario.

In 2025, we aim to achieve these goals…

Pay down debt Cut down on unnecessary shoppingOur monthly grocery budget is $400.00, which we try to keep to a maximum of $100 per week.

Typically, we shop for groceries at the following stores: Wholesale Club, No Frills, and Brady’s Meat.

We started shopping at Giant Tiger and Food Basics when sales are good.

In October, we saved $37.29 by using flyer sales and avoiding purchases of items we didn’t need.

We don’t roll over extra, nor do we roll over overages. Each month is on its own accord.

Signed,

Grumpy Grocery Shopper X 2

The post October 2025 Home Budget Update appeared first on Canadian Budget Binder Your Way To Debt-Freedom.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·