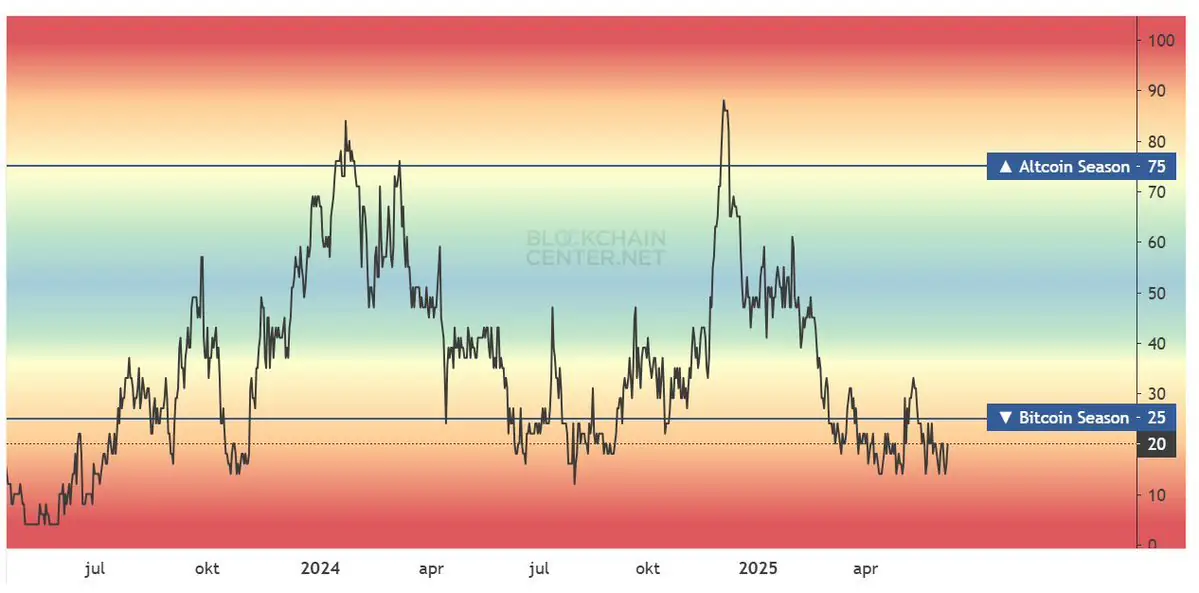

In a detailed post, van de Poppe emphasized that altseason is more than just a buzzword. According to him, those who enter during the actual hype phase often miss the best gains. Historically, the real opportunity comes before the term “altseason” even starts trending.

Van de Poppe traced the last true altseason back to 2017, when nearly every altcoin surged. He noted this didn’t repeat in 2021 or 2025. In his view, 2024’s memecoin craze and the prolonged bearish trend since 2021 have kept altcoins suppressed and investor sentiment low.

“This cycle is completely different from the others,” he explained. While some still rely on the four-year cycle theory, van de Poppe believes new variables now dominate—such as changing macroeconomic trends and institutional shifts.

He pointed to current central bank behavior, evolving global monetary policy, and rising interest in DeFi as signs of fundamental progress, despite recent underperformance by altcoins. He also noted correlations between Ethereum and the Chinese Renminbi’s strength against the U.S. dollar.

Van de Poppe believes two groups are forming: one still expecting a bear market, and another expecting the start of a fresh bull run. He suggested that both might be wrong — and the real opportunity lies in ignoring timing and focusing on value.

He added that Bitcoin’s new highs above $100,000 in a high interest-rate environment further prove this cycle defies old models. When rates eventually fall, he predicts even stronger moves across crypto assets.

In conclusion, van de Poppe said his definition of “altseason” isn’t tied to hype or timing. Instead, it’s the moment when investors can accumulate strong, undervalued altcoins while sentiment remains low — the most uncomfortable, yet potentially rewarding, time to invest.

The post Michaël van de Poppe Reveals When Altseason Might Begin appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·