A comprehensive analysis of Latin American cryptocurrency media performance during the first quarter of 2025 reveals a stark reality: nearly three-quarters of regional crypto outlets experienced significant traffic declines, while market concentration reached unprecedented levels with just six publications controlling over two-thirds of the ecosystem.

The findings come from a report by Outset PR’s internal media monitoring system and is based on traffic data from 55 active crypto publications across the region. It paints a picture of an industry grappling with market volatility, algorithmic changes, and structural challenges that have fundamentally reshaped the media landscape.

Regional Crypto Adoption Surge Creates Media Opportunity

Latin America’s cryptocurrency market has emerged as a global powerhouse, with on-chain transaction volumes surging 42.5% year-over-year to reach $415 billion, establishing the region as the world’s second-fastest-growing crypto market. This explosive growth has positioned countries like Argentina and Brazil as hosts to many of 2025’s most significant cryptocurrency events.

However, the media ecosystem serving this expanding market tells a different story. While the rapid growth in crypto adoption has created opportunities for organic media coverage, volatile market conditions and evolving search engine algorithms have turned this potential into a challenging landscape for publishers.

Methodology: Tracking Active Publications Through Market Turbulence

The analysis focused exclusively on cryptocurrency publications that maintained consistent activity throughout the first quarter of 2025. Many previously active outlets were excluded due to dormant status, redirected domains, or ceased operations. Notable casualties included several established players whose domains either redirected to unrelated content or became completely inaccessible.

The study applied strict criteria to ensure data accuracy: publications needed to demonstrate consistent desktop and mobile traffic across all three months, maintain independence without redirects or rebrands, and serve primarily Latin American audiences. Sites where regional readers represented only minor portions of total traffic were excluded from the analysis.

This filtering process resulted in a dataset of 55 publications spanning crypto-native outlets, finance/crypto hybrids, and traditional economic publications with some cryptocurrency coverage.

January: Bitcoin Rally Drives Traffic Baseline

The quarter began with the Bitcoin price reaching new heights above $109,000, driven by post-Trump inauguration optimism and continued institutional investment. This price surge coincided with significant misinformation campaigns in Brazil involving the Pix payment system, which blurred lines between legitimate economic policy and cryptocurrency speculation.

The confluence of crypto narratives with mainstream economic themes attracted audiences beyond traditional crypto readers, benefiting hybrid finance publications and economic news desks. Traditional financial outlets dominated traffic rankings, with the top performers achieving between 3.57 million and 37.75 million visits.

At the opposite end of the spectrum, smaller crypto-focused publications struggled with minimal traffic, some recording fewer than 1,000 monthly visits. Total cumulative visits across all monitored publications reached 94.48 million, establishing the baseline for subsequent analysis.

February: Perfect Storm Creates Steepest Quarterly Decline

February delivered a devastating combination of market pressures and technical challenges. Bitcoin plummeted approximately 17% following major exchange security breaches, memecoin controversies, and new trade tensions sparked by US tariff announcements affecting Mexico and Canada. Several altcoins experienced losses ranging from 30% to 50%.

Simultaneously, early signals of Google’s anticipated March algorithm update began affecting search visibility. Pages dropped in rankings, indexed content reshuffled, and audience discovery pathways narrowed significantly.

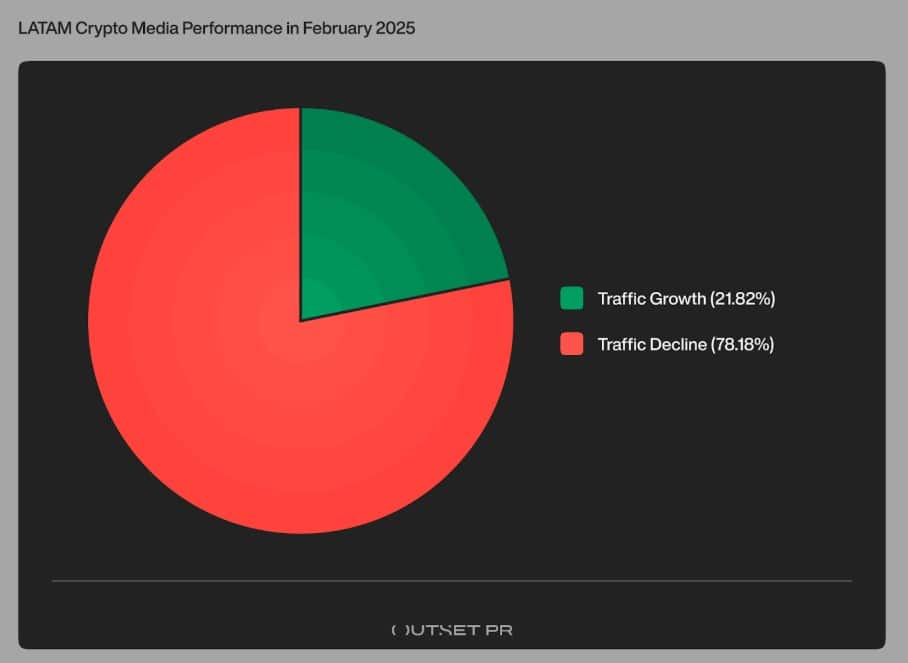

The result was catastrophic for the regional media ecosystem: 78.18% of publications lost traffic, representing the quarter’s steepest imbalance. Only 21.82% managed to achieve growth compared to the previous month.

Source: Outset PR

The performance disparity was extreme. Top gainers achieved growth rates exceeding 135%, while the worst performers saw traffic decline by up to 95%.

The top-performing outlets included:

criptotendencias.com (+135.05%) observatorioblockchain.com (+99.64%) criptoinforme.com (+62.47%) economiaempauta.com.br (+43.77%) criptomonedas.eu (+43.75%)The platforms suffering the most were:

cryptonews.com/br (-94.98%) criptoeconomia.com.br (-80.59%) portalcripto.com.br (-74.57%) compraracciones.com (-71.08%) es.coingape.com (-68.12%)Total cumulative visits dropped to 81.53 million, representing a 13.71% decline from January levels.

March: Algorithmic Reshuffling Continues Market Polarization

March brought continued Bitcoin volatility, with prices fluctuating between $83,000 and $94,000 amid ongoing geopolitical tensions and market uncertainty. Despite brief rallies following announcements about a potential US Strategic Bitcoin Reserve, macroeconomic pressures prevented sustained recovery.

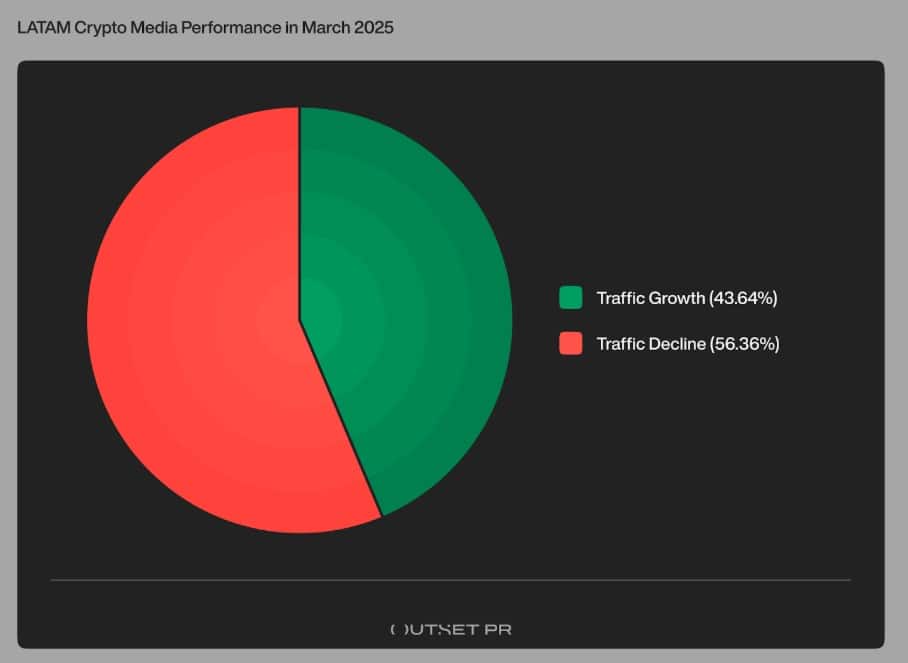

The long-awaited Google algorithm update finally materialized, fundamentally reshaping the regional crypto media landscape. While momentum began returning with 24 of 55 outlets gaining traffic, the field remained highly polarized with the majority of publishers continuing their trajectory of decline.

Source: Outset PR

Performance variations were dramatic, with leading gainers achieving growth rates approaching 281% while the steepest declines reached 64%. Cryptonews.com/br went dark by the end of Q1 (-100%). Its domain was inaccessible from within Brazil, likely due to local legislation around betting-related content, though the site remained accessible from other regions.

Cumulative visits recovered to 85.59 million, representing a 4.98% improvement from February but remaining well below January’s baseline.

Market Concentration Reveals Structural Challenges

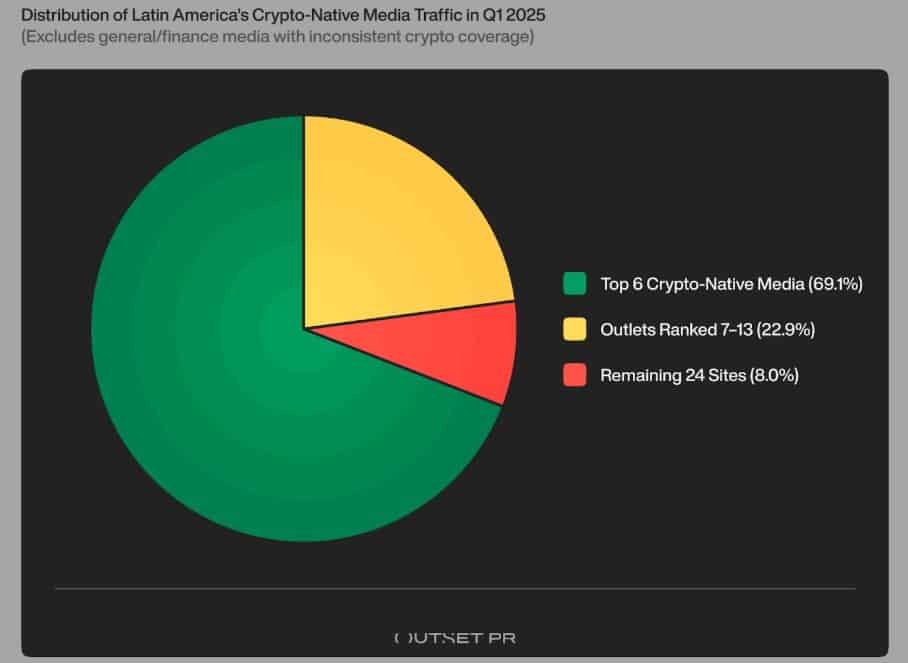

The quarterly analysis exposed a fundamental characteristic of the Latin American crypto media ecosystem: extreme concentration among a small number of publications. Despite reviewing numerous outlets with monthly traffic exceeding one million visits, none qualified as crypto-native publications.

High-traffic financial outlets like Ámbito Financiero, InfoMoney, and iProfessional fall under general finance and news categories, providing only cyclical cryptocurrency coverage that increases during bull markets and retreats during downturns. Most of these publications are Brazilian-based or significantly influenced by Brazilian market conditions, making them vulnerable to regulatory shifts and content restrictions.

This opportunistic editorial approach to cryptocurrency coverage can inflate estimated campaign reach without ensuring relevance or engagement from dedicated crypto audiences.

Six Publications Dominate Dedicated Crypto Coverage

Among publications focused exclusively on cryptocurrency content, the market concentration is even more pronounced. Just six outlets achieved average monthly visits exceeding 400,000: CriptoNoticias, Cointelegraph Brasil, Livecoins, CriptoFacil, Bitfinanzas, and Portal do Bitcoin.

These six publications collectively generated 4.11 million visits, accounting for 69.13% of total traffic across the 38 crypto-focused sites analyzed. This concentration represents a significant barrier to market entry and highlights the challenges facing smaller publications.

The next tier includes seven outlets attracting between 130,000 and 270,000 monthly visits, demonstrating a sharp drop-off in reach. The remaining publications form a fragmented long tail, with more than half attracting fewer than 91,000 visits monthly and 14 drawing under 10,000 visits.

Brazil’s dominance extends to dedicated crypto coverage, with seven of the top 13 crypto-only outlets publishing in Brazilian Portuguese. This concentration demonstrates both market volume and resilience, even amid the quarter’s traffic declines.

Market Ceiling Establishes Realistic Expectations

Perhaps most significantly, no crypto-only publication crossed the one million monthly visit threshold during the first quarter of 2025, establishing a clear ceiling for dedicated cryptocurrency media in the region. This limitation has important implications for marketing strategies and audience reach expectations.

To achieve seven-figure audience reach, cryptocurrency communication strategies must calibrate around market conditions and consider strategic amplification through high-traffic, non-crypto-specific publications when macroeconomic narratives align, such as during regulatory developments or bull market surges.

Implications for Regional Crypto Communications

The research reveals that successful cryptocurrency media engagement in Latin America requires understanding both the concentrated nature of dedicated crypto coverage and the cyclical patterns of mainstream financial media attention. The extreme market concentration among just six publications creates both opportunities and challenges for organizations seeking regional visibility.

The volatility demonstrated throughout the first quarter suggests that sustainable media strategies must account for dramatic traffic fluctuations and the ongoing impact of search algorithm changes. The failure of nearly three-quarters of publications to maintain growth during this period highlights the structural challenges facing the regional cryptocurrency media ecosystem.

For organizations entering or scaling within Latin America’s crypto space, these insights provide crucial context for realistic expectation setting and strategic media planning in an increasingly concentrated and volatile landscape.

6 days ago

14

6 days ago

14

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·