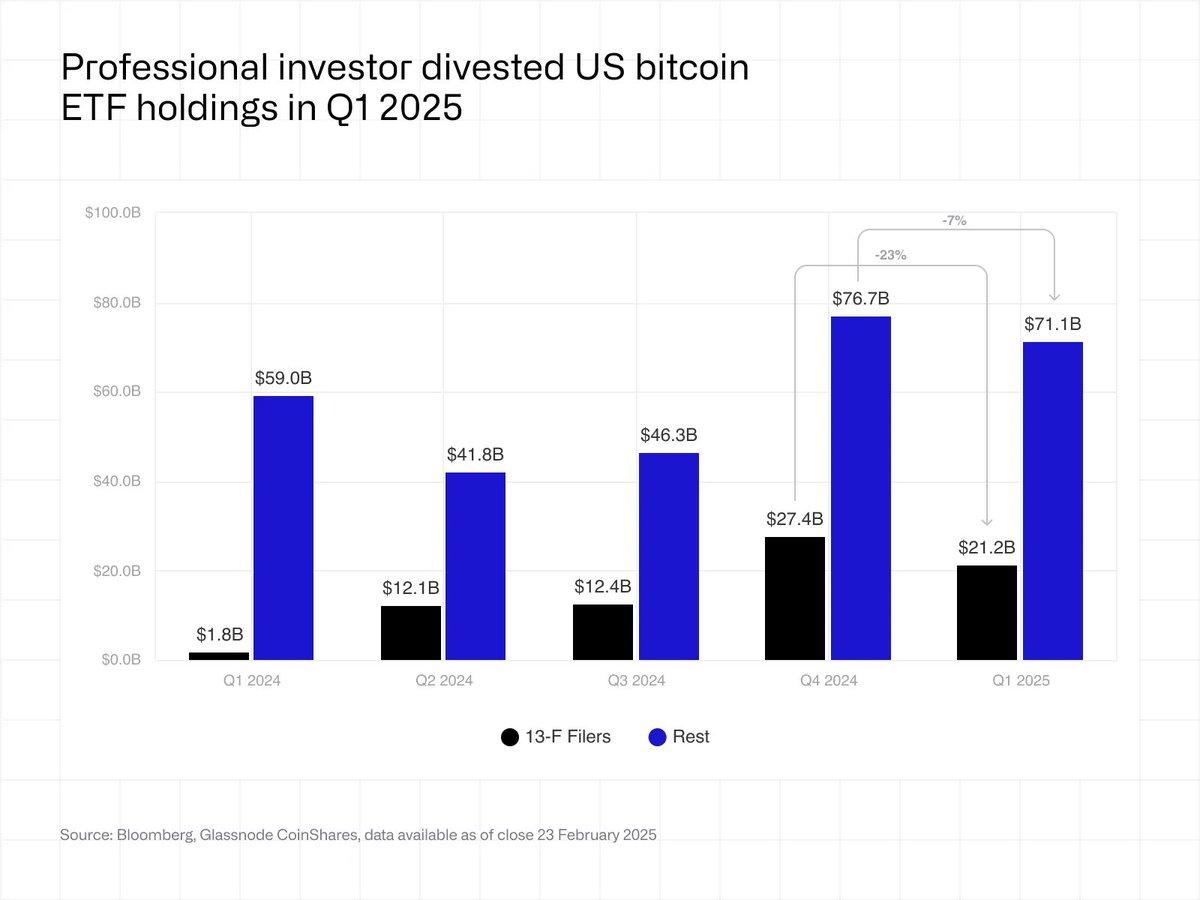

13F filers—a category that includes hedge funds, pensions, and asset managers—reduced their Bitcoin ETF holdings by 23%, shrinking from $27.4 billion in Q4 2024 to $21.2 billion in Q1 2025.

This marks the first quarterly drop in institutional Bitcoin ETF exposure since the SEC approved spot BTC ETFs in early 2024.

The decline contrasts with the more moderate 7% reduction in total ETF assets, which fell from $76.7 billion to $71.1 billion over the same period.

The data suggest that while general interest in Bitcoin ETFs remains robust, professional investors are becoming more cautious, possibly in response to broader macroeconomic factors, regulatory uncertainty, or shifting risk appetite.

Q1’s decline follows four consecutive quarters of growth in institutional participation. It remains to be seen whether this downturn is temporary or the start of a more sustained pullback.

The post Institutional Bitcoin ETF Holdings Drop 23% in Q1 2025—First Decline Since Launch appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·