Key Points

Paying off student loans is a huge milestone. But making your final student loan payment isn’t always as simple as sending in the balance on your last statement. If you don’t calculate the correct loan payoff amount, you could end up short and that small mistake can lead to late fees, penalties, and even negative marks on your credit report.

Take “Sam,” a reader who thought he had paid off his $6,457 balance after receiving a work bonus. He sent in the statement amount, celebrated being debt-free, and ignored future mail from his lender only to later discover he still owed $111 in past-due charges.

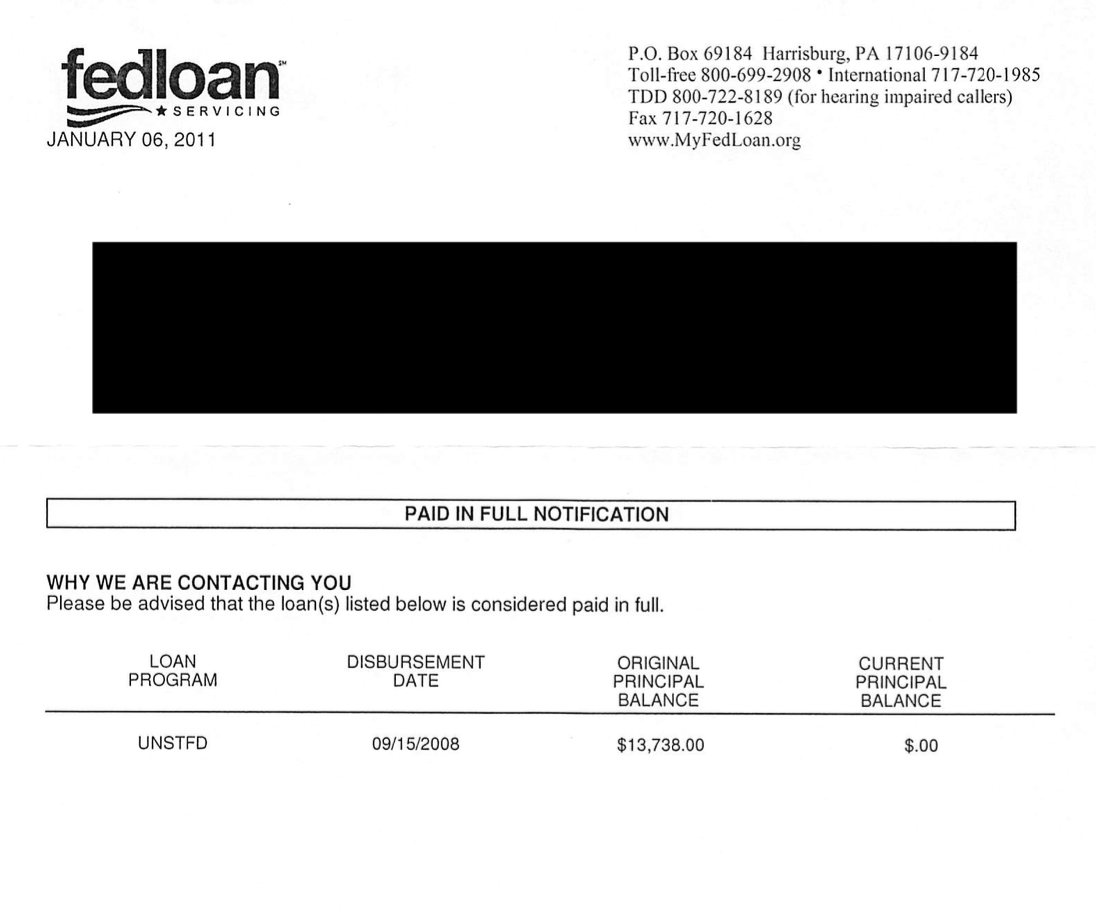

To avoid this kind of situation, here’s a step-by-step guide to making your final student loan payment the right way, so you can get a "Paid In Full Notification" like mine:

Paid In Full Notification. Source: Robert Farrington

Would you like to save this?

1. How To Find Your Student Loan Payoff Amount

Your payoff amount is not the same as your statement balance. Because interest accrues daily, the amount you owe will depend on the exact date you make your last payment.

Ways to get your payoff amount:

Log in to your loan servicer’s website and look for a “Loan Payoff” or “Payoff Quote” option under billing.Call your lender directly and ask for the payoff amount for your desired payment date.2. Steps To make Your Final Student Loan Payment

Once you have the payoff amount, follow this checklist to complete the process smoothly:

Choose your payment date carefully (interest changes the balance daily). We recommend choosing a date 3-4 weeks out, so there is plenty of time to ensure that the check or wire transfer clears.If paying online, confirm you’ve selected “pay off loan” rather than a regular monthly payment.If mailing a check, send it 7-10 days early to ensure it arrives before the payoff quote expires.Turn off autopay after confirming the loan is paid in full, to prevent accidental extra drafts.3. How To Confirm Your Loan Is Paid Off?

After submitting your final payment, take these steps to ensure your debt is fully cleared:

Look for a payoff letter: Your lender should send a “Paid in Full” notification. Save this document permanently.Check your credit report: Within 90 days, confirm the loan shows as a $0 balance. You can use AnnualCreditReport.com or free credit tools like Credit Karma.Monitor your accounts: Make sure no additional payments are pulled, especially if you had autopay set up.4. What If You Overpay or Underpay?

If you underpay: You’ll still owe a small balance, and interest/fees may continue to accrue. Always double-check your payoff amount before submitting. You may have to repeat this process above if you underpay.

If you overpay: Lenders issue a refund, but it may take a few weeks. Contact your servicer if you don’t see it applied back to your bank account or receive a check within 6-8 weeks.

Common Questions

Does paying off student loans early save money?

Yes. By paying before your scheduled term ends, you reduce the amount of interest you’ll pay over time.

Will my credit score go up after paying off student loans?

It can. Your score may improve because your debt-to-income ratio drops, but sometimes it stays flat since an installment account is closed.

Do I need to notify my servicer before making the final payment?

It’s a good idea, especially for mailed payments. Requesting a payoff statement ensures accuracy.

Don't Miss These Other Stories:

Editor: Clint Proctor Reviewed by: Chris Muller

The post How to Make Your Final Student Loan Payment (and Avoid Mistakes) appeared first on The College Investor.

2 months ago

52

2 months ago

52

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·