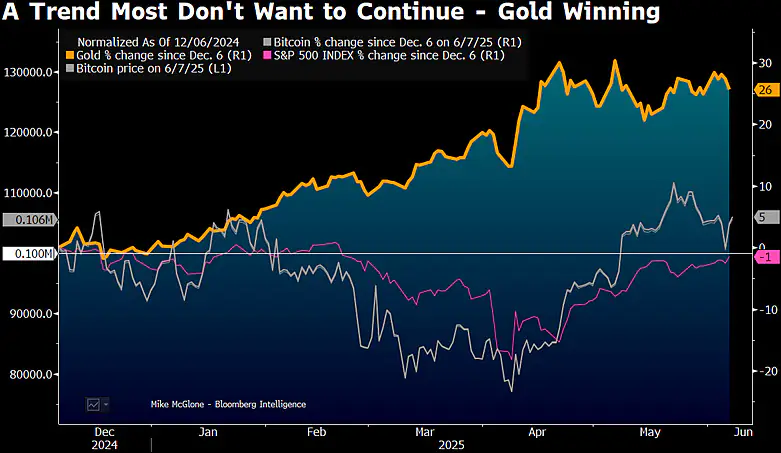

In a new post, McGlone highlights a concerning divergence. Since BTC hit six figures, gold has steadily beaten both BTC and the S&P 500, raising questions about where capital is flowing during macro uncertainty.

The data shows:

Gold has gained ~26% since December 2024. Bitcoin has barely moved, fluctuating near its $100K peak. The S&P 500 remains relatively flat to slightly negative in the same timeframe.“A trend most don’t want to continue — gold winning,” reads the chart header from Bloomberg.

Crypto Saturation Adds Pressure

McGlone also flags a rising structural risk: the sheer number of cryptocurrencies. With over 16 million tokens now listed on CoinMarketCap, the market may be facing supply-driven limitations on future price appreciation.

While innovation remains a key crypto driver, the lack of filtering or quality control across tokens could lead to volatility, dilution, and investor fatigue.

“Highly speculative, volatile cryptos face unchecked supply and competition,” he warns.

What This Means for Investors

McGlone’s message is cautionary: If Bitcoin struggles to reclaim momentum above $100K and gold continues its run, risk assets may face headwinds from:

Interest in safer inflation hedges Oversaturation of crypto markets Broader macroeconomic uncertaintyAlthough Bitcoin and crypto remain structurally bullish in the long term, this data implies that near-term upside could be capped—unless a major catalyst reignites demand.

The post Gold Outshines Bitcoin and Stocks as Market Hits $100,000 BTC Wall, Says Bloomberg Analyst appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·