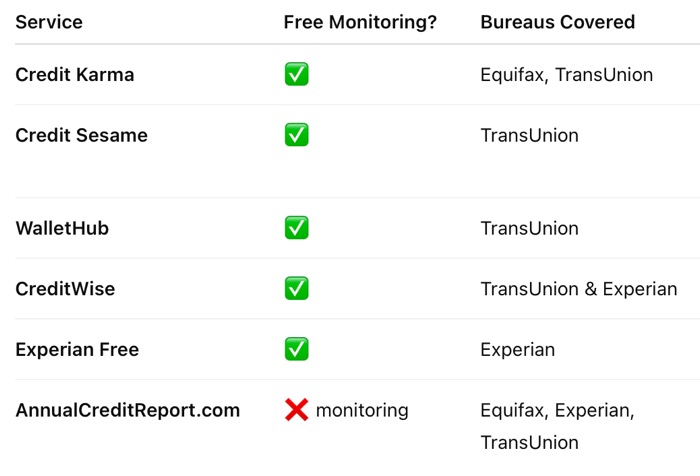

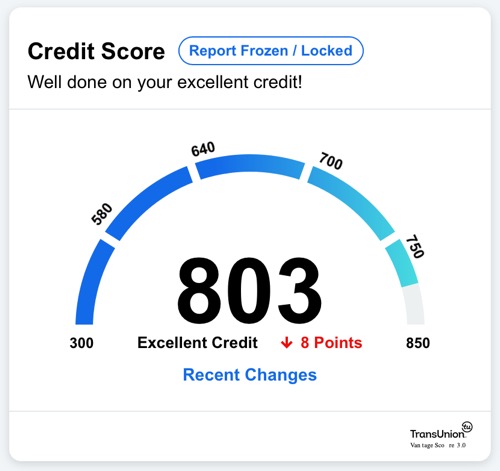

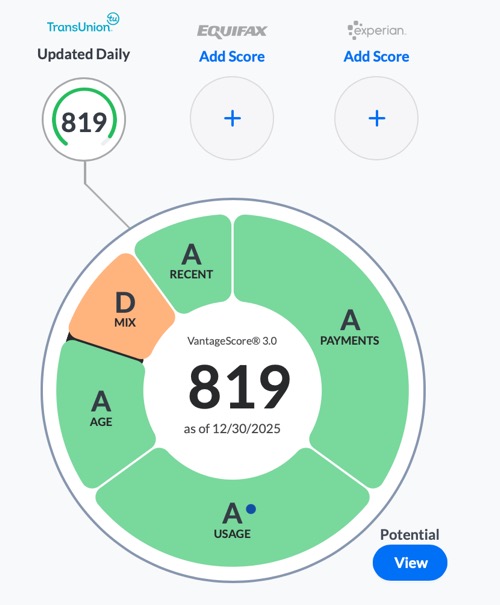

Updated. Happy New Year! 🎉 🥳 In terms of keeping my finances in order, what I’ve been finding most useful recently are credit monitoring alerts. The last time I applied for a credit card, I received multiple e-mails within minutes alerting me that someone had checked my credit report. I’m also told if a new account is added. This makes me feel more comfortable knowing that I’ll be alerted quickly if someone does try to steal my identity. The following third-party services listed below provide you a free credit score (of various algorithms) and/or free continuous credit monitoring from select credit bureaus.

Free credit score (VantageScore 3.0) from both Transunion and Equifax. Free credit monitoring from both Transunion and Equifax. Via e-mail alerts or app notification. Will let you know about things like a new credit check or a new account added. Limited identity theft monitoring. Credit Karma uses your email address to search and notify you if they are listed in public data breaches. Free credit score (VantageScore 3.0) from Transunion. Daily credit score updates and weekly credit report profile updates. Free credit monitoring from Transunion. Via e-mail alert. Will let you know about things like a new credit check or a new account added.

None of the services above require a trial or credit card number to sign up for their free tiers. They may ask for the last 4 digits of your SSN for verification. These are all ad-supported (they will pitch you stuff) and usually have a paid upgrade option (but you can stay on the free tier forever).

The government requires the credit bureaus to provide you a free credit report at least once every 12 months (now actually weekly since the pandemic). However, the site will not provide you credit scores or pro-active alerts if anything changes on those reports.

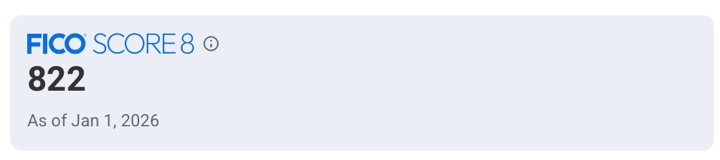

Note that some of the scores above are not FICO scores because Fair Isaac might charge more money in licensing fees. If you really want a FICO number, nearly every major credit card issuer now includes a monthly FICO score with their cards: Chase, Citi, Bank of America, Discover, Barclaycard, and American Express.

Bottom line. Used in combination, I use the services above to keep track of changes to my credit reports across all three credit bureaus for free. None of them require my credit card number, and they quickly alert me to things like new accounts, new credit check inquiries, and high credit line usage. I just ignore the generic ads and upsells.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·