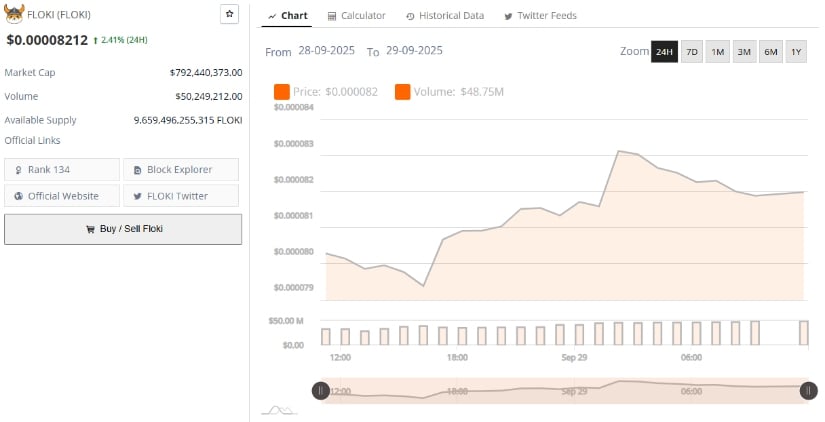

Price currently trades at $0.00008212, up 2.41% in the past 24 hours, with the chart structure suggesting a possible rally could be in play.

Analyst hinted at momentum building, urging that it may be time to “start the pump right now,” as the crypto hovers within a narrowing price channel.

Ascending Channel Builds Tension

Professor Astrones highlights a rising channel pattern that has shaped FLOKI’s price action through 2025. The token has formed successive higher lows while encountering resistance near the channel’s upper boundary, a structure often associated with accumulation before stronger moves.

Recent bounces off support have reaffirmed buyer interest at lower levels, setting the stage for a possible continuation higher.

Source: X

If the channel holds, upside targets point toward the $0.00012–$0.00015 range, with the analyst outlining the potential for a multi-month climb.

However, a failure to sustain above the midline of the structure could expose the asset to a deeper retest near $0.000070. Traders are closely watching the balance between volume and momentum to confirm whether this setup is gearing up for a breakout or another phase of consolidation.

Market Data Shows Steady Participation

Fresh figures from BraveNewCoin reinforce FLOKI’s liquidity backdrop. The token carries a market capitalization of $792.4 million with a 24-hour trading volume of $50.2 million.

Circulating supply sits at 9.65 trillion tokens, placing the project at rank #134 by market cap. Despite its meme-coin origins, the token continues to demonstrate consistent market participation, suggesting its community-driven appeal remains intact.

Source: BraveNewCoin

In recent sessions, volume has stayed in the $45–$55 million band, highlighting stable activity even amid broader market swings.

With price holding above $0.000080, the near-term outlook suggests cautious optimism, though a sustained move beyond $0.000090 would be needed to validate bullish continuation scenarios.

Indicators Signal Mixed Momentum

Technical indicators from TradingView offer a nuanced perspective. FLOKI trades near the lower edge of its Bollinger Bands, with the basis at $0.00009302 and support around $0.00007575.

Trading near the lower band often signals oversold conditions, though confirmation from volume and price action will be needed for a rebound.

Source: TradingView

The Chaikin Money Flow (CMF) sits at -0.01, reflecting mild outflows and a lack of strong accumulation pressure at present. While this doesn’t confirm bearish momentum, it underscores a wait-and-see approach from larger participants. A shift into positive CMF territory could validate a near-term bounce toward the mid-band resistance.

Overall, the crypto is at a pivotal juncture, holding the channel support, and reclaiming momentum could set the stage for a pump toward $0.00012, but weakness below $0.000075 risks delaying the move.

2 months ago

53

2 months ago

53

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·