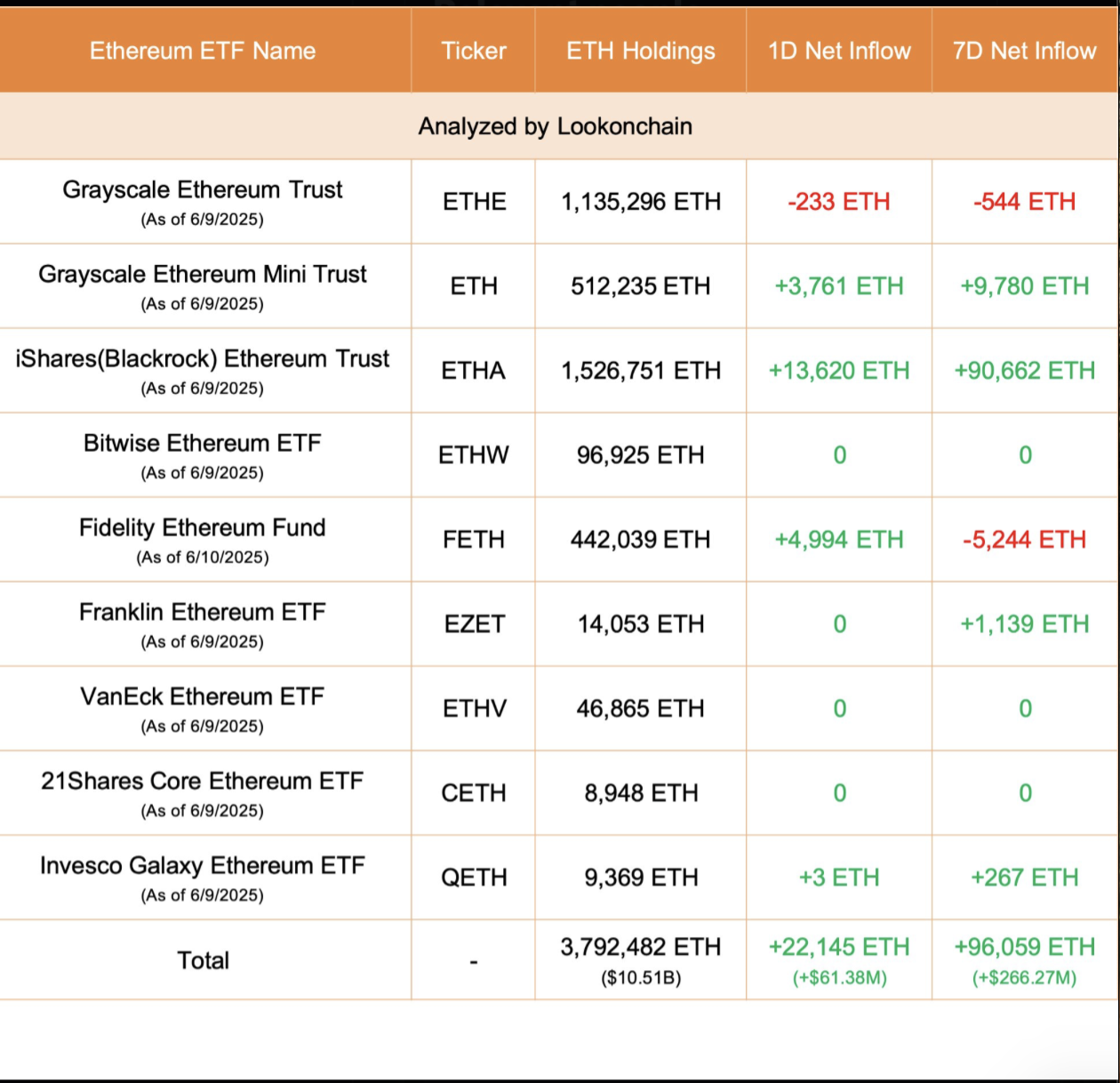

This data, analyzed by Lookonchain as of June 10, 2025, highlights a growing appetite for regulated Ethereum investment products.

BlackRock’s ETHA Leads the Charge

The iShares (Blackrock) Ethereum Trust (ETHA) has quickly established itself as the leading Ethereum ETF, holding an impressive 1,526,751 ETH as of June 9, 2025. ETHA recorded substantial inflows, with a staggering +13,620 ETH in 1-day net inflow and an even more remarkable +90,662 ETH over the past seven days. This strong performance underscores its appeal to investors seeking exposure to Ethereum.

Fidelity and Grayscale’s Mixed Trends

The Fidelity Ethereum Fund (FETH), as of June 10, 2025, saw a significant +4,994 ETH inflow in one day, pushing its total holdings to 442,039 ETH. However, it experienced a -5,244 ETH net outflow over the past seven days, indicating fluctuating investor sentiment.

The Grayscale Ethereum Trust (ETHE), similar to its Bitcoin counterpart, continues to face outflows. As of June 9, 2025, ETHE recorded -233 ETH in 1-day net outflow and -544 ETH over seven days, despite holding a substantial 1,135,296 ETH. In contrast, the Grayscale Ethereum Mini Trust (ETH) is attracting capital, with +3,761 ETH in 1-day net inflow and a robust +9,780 ETH over the last seven days, bringing its holdings to 512,235 ETH as of June 9, 2025.

Other ETFs Show Steady Activity

Several other Ethereum ETFs are maintaining their presence. The Invesco Galaxy Ethereum ETF (QETH) saw a modest +3 ETH 1-day net inflow and +267 ETH over seven days, with 9,369 ETH in holdings as of June 9, 2025.

Franklin Ethereum ETF (EZET), as of June 9, 2025, reported zero 1-day net inflow but a positive +1,139 ETH over seven days, holding 14,053 ETH.

Bitwise Ethereum ETF (ETHW), VanEck Ethereum ETF (ETHV), and 21Shares Core Ethereum ETF (CETH) all showed zero net inflows for both the 1-day and 7-day periods as of June 9, 2025. Their respective holdings are 96,925 ETH, 46,865 ETH, and 8,948 ETH.

Overall, the data points to a growing embrace of Ethereum ETFs, with BlackRock’s offering leading the charge in attracting new investments and total assets under management.

The post Ethereum ETFs Surge: BlackRock’s ETHA Leads Massive Inflows appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·