After weeks of quiet buildup, the network is now catching attention on multiple fronts, from big exchange listings to whale buys and even a fresh DeFi protocol announcement. This could be the beginning of a real breakout phase. With Bitcoin around all-time highs again and altcoin sentiment improving, ADA Cardano price might be setting up for a powerful move.

Cardano Now Listed on Bitstamp via Robinhood

Cardano just widened its reach in the U.S. market with Bitstamp. With increased exposure and easier access, ADA is stepping into a bigger arena, one that could drive more liquidity and more visibility. This expansion matters because it brings ADA to where more users already are. Bitstamp’s integration with Robinhood means quicker access, smoother trading, and fewer barriers for everyday investors.

ADA expands U.S. presence with Bitstamp listing through Robinhood. Source: Bitstamp via X

Bitstamp serves around 5 million retail and institutional customers globally. With ADA now live on the platform, it’s now positioned to compete at higher levels.

Whale Activity Signals Confidence in ADA

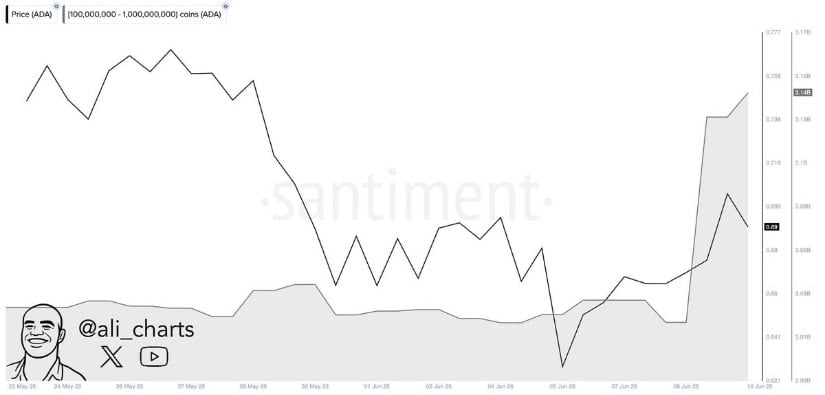

Fresh off its expanded listing on Bitstamp via Robinhood, Cardano is catching serious attention. In a recent post shared by Crispy, whales have reportedly added 120 million Cardano in the last 48 hours. This is a strategic accumulation, and it sends a clear message: big players are positioning themselves.

Whales accumulate 120 million ADA in 48 hours, signaling strong confidence in Cardano’s growth potential. Source: Crispy via X

This kind of volume does suggest rising conviction in ADA Cardano’s price near-term prospects. With easier access through Bitstamp and an influx of institutional-sized buys, Cardano is stacking up tailwinds that could shift its momentum.

ADA Cardano Price Gears Up for Breakout

With Bitcoin charging toward $110K, ADA’s correlation is kicking in just as its fundamentals are aligning with broader market optimism. Cardano’s recent price push above the $0.70 mark is more than just a psychological milestone; it lines up with improving technical structure on the 4H chart. The 50-period SMA has just been reclaimed, showing ADA flipping short-term momentum in its favor. Additionally, RSI is approaching overbought territory near 69, showing increasing momentum.

ADA nears breakout as it reclaims $0.70 with strong momentum. Source: Sssebi via X

Sssebi believes the next logical resistance sits near $0.75, a level where the price was previously rejected in May. If ADA can break that on volume, the door opens toward $0.90 and beyond.

Weekly Fractal Mirroring 20/21 Cycle

ADA isn’t just riding on Bitcoin’s momentum; rather, it’s establishing a setup of its own. On the weekly chart shared by Matthew Lake, Cardano is forming a bullish continuation pattern inside a rising channel, with price trading tightly near the upper boundary.

ADA’s weekly chart forms bullish continuation, echoing 20/21 cycle patterns. Source: Matthew Lake via X

The trendlines show clear higher lows, and the chart structure mirrors previous breakouts ADA experienced in 20/21, leading to a major rally. If ADA clears this triangle to the upside, the chart projects a strong move toward the $0.90 to $1.00 range. What’s more, ADA’s current posture on the weekly RSI is relatively neutral at 52, leaving plenty of room to run.

Cardano Gets An Infrastructure Boost

Just as ADA gains traction with listings and whale interest, Cardano is pulling another card from its deck. Charles Hoskinson has officially unveiled Cardinal, the first Bitcoin DeFi protocol on the Cardano network. It’s a move that brings real utility to the chain, bridging Bitcoin’s liquidity into Cardano’s ecosystem. This is a major fundamental boost for Cardano’s infrastructure. If Cardinal gains traction, this could be a turning point and would have a positive impact on Cardano’s price.

Final Thoughts

Despite ADA’s slow pace earlier this year, the recent wave of bullish developments is improving the overall sentiment. If Bitcoin continues to push higher and Cardano breaks past $0.75 with solid volume, price could be staring down a run to $1.00 and beyond. With technicals heating up and fundamentals gaining strength, the pieces are on the board.

5 days ago

3

5 days ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·