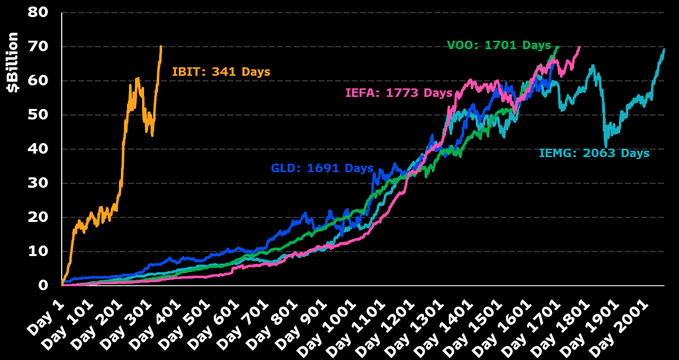

The achievement places IBIT far ahead of other major ETFs in terms of early asset accumulation. By comparison, it took:

VOO (S&P 500 ETF) 1,701 days IEFA (iShares Core MSCI EAFE ETF) 1,773 days GLD (SPDR Gold Trust) 1,691 days IEMG (iShares Emerging Markets ETF) 2,063 days“No other ETF even close,” Geraci wrote, calling the numbers “ridiculous.”

A Historic Category Surge

While IBIT leads the pack, it is just one of 12 approved spot Bitcoin ETFs in the U.S. Together, they now hold nearly $125 billion in combined AUM, underscoring the institutional rush into digital assets since regulatory approval was granted in early 2024.

The sharp inflow into IBIT highlights not just investor demand for Bitcoin exposure, but also BlackRock’s dominance in ETF distribution. The chart, originally shared by ETF analyst Eric Balchunas, vividly illustrates how quickly BTC-based financial products have outpaced even traditional equity and commodity ETFs in early-stage adoption.

The post BlackRock’s IBIT Hits $70 Billion in Record Time, Outpaces Every ETF in History appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·