Bitcoin analysts are presenting contrasting views on BTC‘s next major move, reflecting diverging interpretations of current market structure.

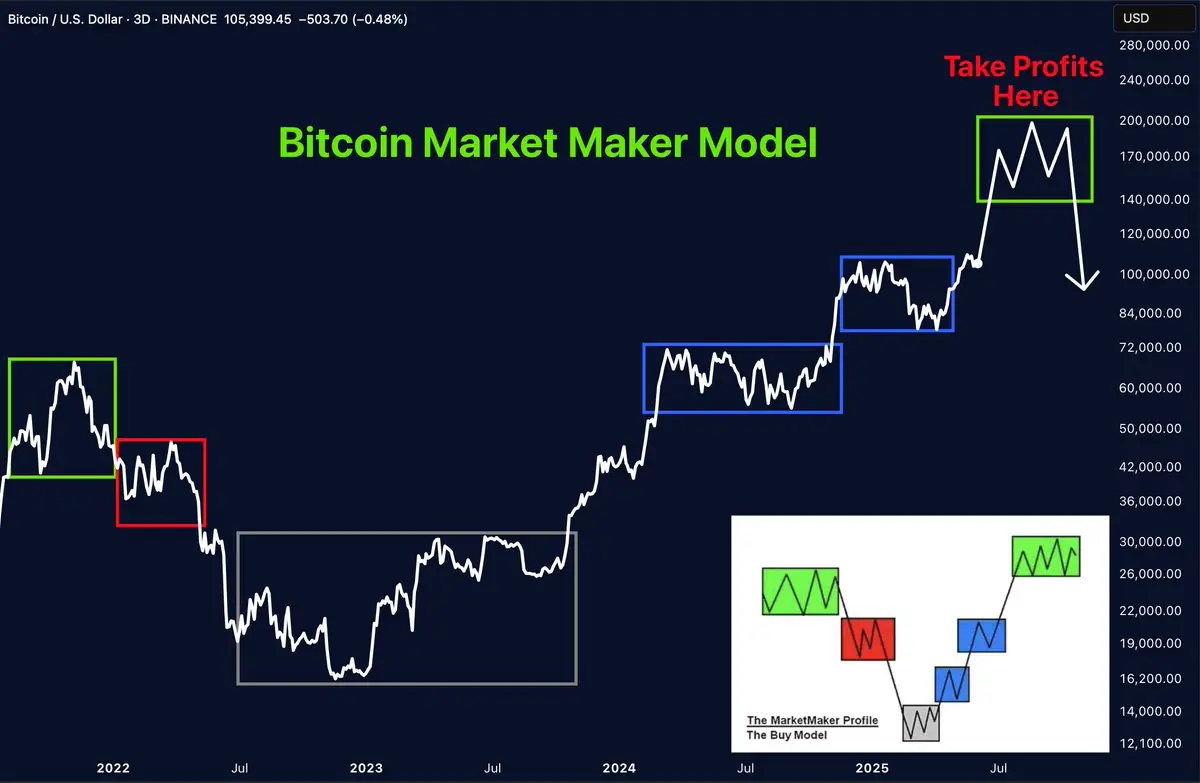

According to trader Merlijn The Trader, Bitcoin is unfolding “perfectly” in line with the Market Maker Model—a structure that maps cycles of accumulation, reaccumulation, and markup.

In his latest update, he suggested that the accumulation and reaccumulation phases have concluded, and the market is now entering “markup madness.” His price target for this phase? $140,000 and beyond, with a proposed profit-taking zone as high as $240,000.

“This is where legends cash out. Don’t miss your moment,” Merlijn emphasized.

Van de Poppe Counters with Caution on BTC Dominance

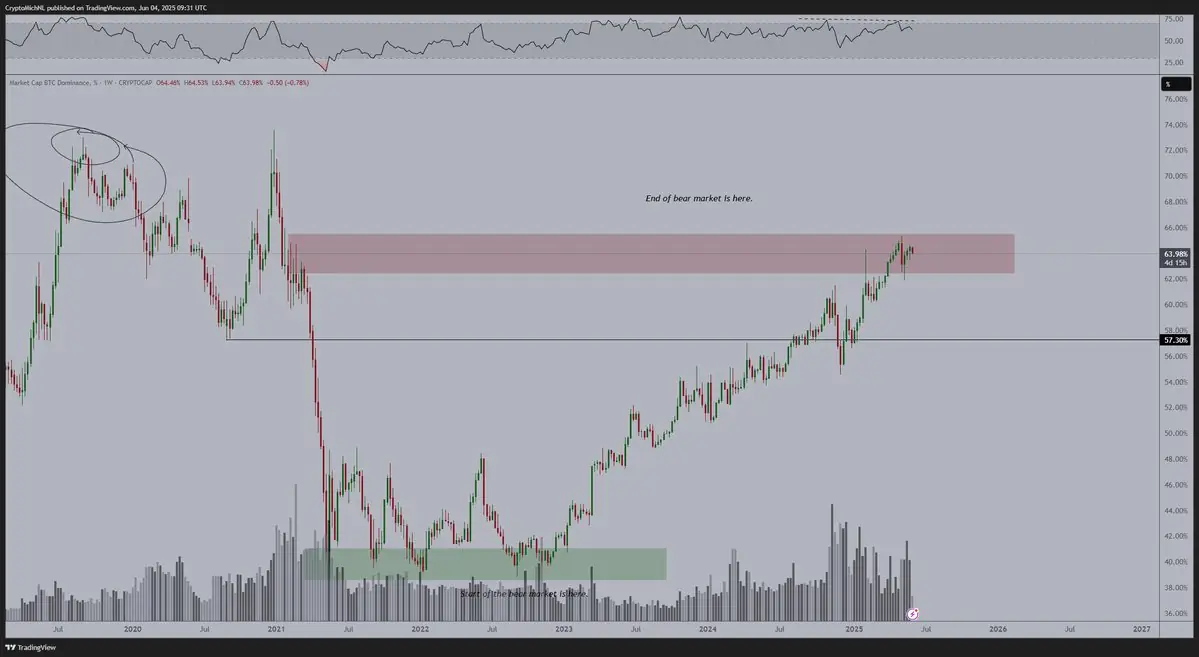

In contrast, trader Michaël van de Poppe took a more cautious tone, pointing to a bearish divergence in Bitcoin dominance—a technical indicator that can often precede a shift in capital toward altcoins or signal weakness in BTC’s trend leadership.

“I assume that this will continue in the upcoming weeks as yields continue to fall,” van de Poppe noted.

His chart shows BTC dominance stalling within a resistance zone around the 53–54% level, despite broader price strength.

What It Means

Bullish case: If Merlijn’s model holds, BTC could be primed for a breakout well into six-figure territory, driven by institutional flows and a classic markup cycle. Bearish divergence: Van de Poppe’s analysis suggests caution, especially if the dominance divergence accelerates amid macro pressure or increased altcoin interest.Both perspectives highlight the critical juncture at which Bitcoin currently sits — with bulls eyeing a breakout and others watching for signs of fatigue in its market leadership.

The post Bitcoin Price Outlook Split: One Trader Sees $140K Surge, Another Warns of Dominance Divergence appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·