The milestone, combined with a day of zero outflows across all major ETF products, reflects renewed institutional conviction in Bitcoin’s long-term upside.

Net Inflows Top $117 Million, Led by BlackRock and Fidelity

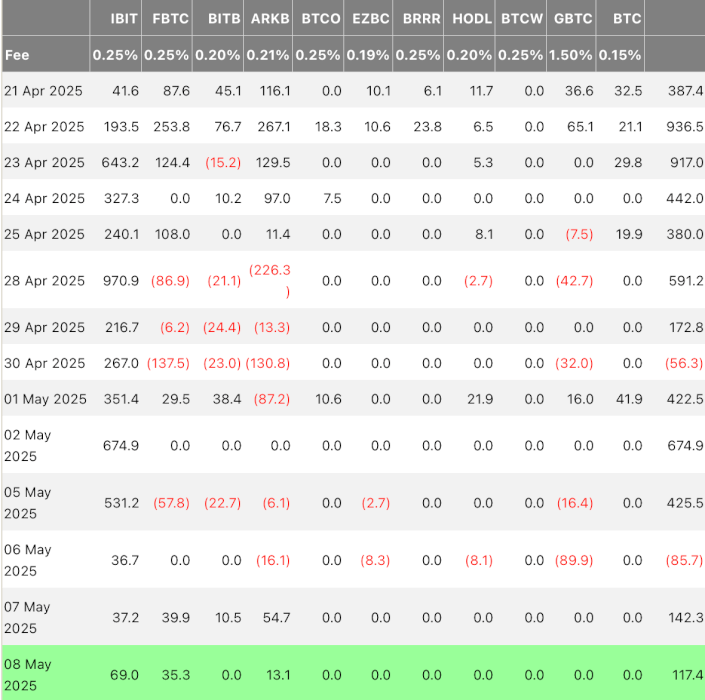

According to Farside, net inflows across all U.S. spot Bitcoin ETFs totaled $117.4 million for the day—slightly lower than Wednesday’s $142.3 million, likely due to minor profit-taking after BTC crossed the psychological six-figure threshold.

Despite the daily dip, ETF inflows remained robust. BlackRock’s iShares Bitcoin Trust (IBIT) led the way with $69 million in inflows, pushing its cumulative net inflow to an impressive $44.3 billion.

Fidelity’s FBTC followed with $35.3 million in net inflows, bringing its total to $11.6 billion since inception.

No Outflows Reported, Reinforcing Bullish Sentiment

Notably, none of the major spot Bitcoin ETFs experienced any outflows during Thursday’s session. This rare event suggests that investors—both retail and institutional—are showing high conviction and holding through recent volatility.

The consistent inflows amid Bitcoin’s renewed rally indicate a maturing ETF market that is increasingly being used as a long-term exposure vehicle rather than a speculative tool.

The post Bitcoin ETFs Log Continued Inflows as BTC Reclaims $100,000 appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·