The 2.48% intraday drop triggered a wave of liquidations across the crypto derivatives market, wiping out nearly $986 million in positions.

Mass Liquidations: Longs Hit Hardest

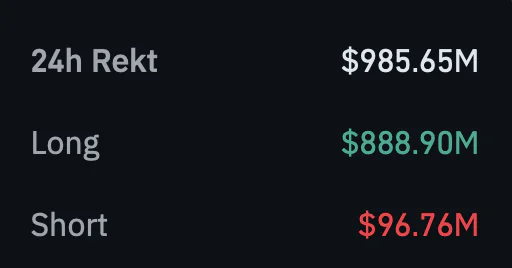

According to Coinglass, a staggering 227,964 traders were liquidated within a 24-hour span, resulting in total losses of $985.58 million. Long positions accounted for the majority of the damage, with $888.83 million in longs erased versus $96.75 million in shorts. The largest single liquidation order was recorded on BitMEX (XBTUSD), valued at $10 million.

Market Sentiment Hit by External Headwinds

Several macro and geopolitical factors appear to have catalyzed the sudden downturn:

Ongoing U.S.-China trade war tensions have flared again, pressuring global risk assets and weakening investor sentiment. The unexpected public fallout between Elon Musk and President Donald Trump added further instability. Musk accused Trump of being listed in the sealed Epstein files, escalating a very public feud.Trading Volume Surges

Despite the drop, trading volume surged by 36.24% to $60.39 billion, suggesting that volatility brought heavy activity. Bitcoin’s market cap currently sits at $2.03 trillion, with a circulating supply of 19.87 million BTC.

Outlook

With nearly $1 billion wiped out in leveraged trades, and macro headwinds intensifying, traders are now approaching the market with renewed caution. Bitcoin remains above the psychological $100K threshold, but short-term sentiment has clearly taken a hit.

Unless external pressures ease and confidence returns to the tech sector, Bitcoin could remain vulnerable to further downside volatility in the coming days.

The post Bitcoin Dips Below $101,000 as Nearly $1B in Longs Liquidated Amid Musk-Trump Clash appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·