The past few months have delivered a series of developments that suggest we’re entering a new phase in the evolution of store-of-value assets, one where Bitcoin and gold are viewed as complementary hedges in a world of deepening fiat skepticism.

The timing of these developments is no coincidence. On the one hand, from a macro perspective, we have persistent inflation, negative real rates in many regions, and growing volatility in bond markets, that’s been punctuated by the US credit rating downgrade. On the other hand, we have Bitcoin’s rapidly maturing position as a globally recognised and institutionally adopted asset class, and gold’s continued resilience.

This article looks at how Bitcoin and gold are increasingly working together as alternative stores of value in a shifting macro and financial landscape.

Bitcoin’s continued institutional momentum

We now have ample data pointing to Bitcoin’s acceptance in strategic asset allocation, with an increasingly broad spectrum of investors dipping their toe in.

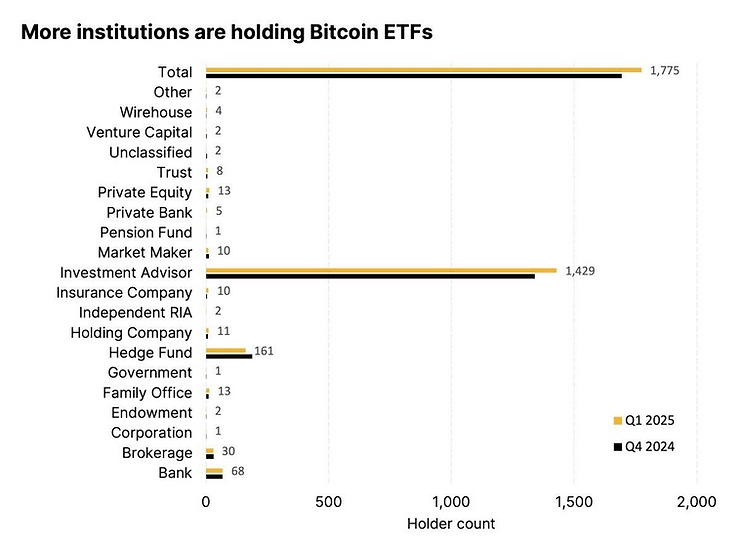

As the chart below illustrates, institutional filings showed 1,775 holders of Bitcoin ETF products in Q1 2025, a 5% increase from 1,690 the previous quarter. Additionally, every single institution type is now represented, from hedge funds and private equity to insurers, pension managers, and even state-connected entities

Of course, the launch of US spot ETFs in 2024, which brought over $75 billion into the asset class in under a year, was a major contributing factor in pushing Bitcoin firmly into the investment mainstream both by providing a regulated avenue for institutions as well as boosting accessibility across the board.

Source: 21Shares

Source: 21SharesMeanwhile, gold has continued to demonstrate resilience in 2025, outperforming Bitcoin year-to-date and maintaining its role as a core hedge in portfolios exposed to inflation, geopolitical risk, and market volatility.

While its underlying narrative remains largely consistent, what has shifted is the scale and profile of capital reallocating into the asset. Renewed demand from central banks, state-level policy initiatives, and institutional allocators is reshaping the monetary landscape.

Bitcoin priced in gold: a window into monetary sentiment

The chart below offers a particularly interesting perspective. It compares Bitcoin to gold rather than to dollars. As of May 2025, one Bitcoin buys just over 33 ounces of gold. That’s a meaningful recovery from the lows, though still below the 2024 high of 41 ounces and the all-time high from 2021.

Source: TradingView, McKayResearch

Source: TradingView, McKayResearchThis suggests that while Bitcoin has rallied strongly in nominal terms helped by ETF inflows, institutional adoption since 2024, gold has held its own in an environment of elevated inflation, capital controls, and creeping fiscal instability.

The coexistence of both trends signals a maturing market structure. In terms of returns, there’s little doubt Bitcoin will continue to outperform gold as its price discovery continues but both have complementary roles in long-term portfolio construction that will come to the fore as confidence in traditional safe havens continues to erode.

Gold adoption: from central banks to state capitols

In the US, state-level policy is also reflecting renewed interest in gold. The news that Governor DeSantis signed House Bill 999 into law, formally recognising gold and silver as legal tender in Florida, might seem symbolic at first glance. However, in the context of inflation anxiety, credit downgrades, and growing distrust in central bank policy, it reads as something much more significant.

At the consumer level, the signal is clear: Florida aims to provide its citizens with alternatives to the dollar to protect themselves from inflation, and DeSantis himself has framed the move as a direct response to the dollar’s declining purchasing power.

It’s worth noting that while Texas, Utah, and Wyoming have already adopted similar measures in the past, this latest recognition of gold and silver as legal tender in the current context bears strong parallels to recent moves to adopt Bitcoin and other digital assets at both state and federal levels.

These initiatives reflect a broader trend of diversifying away from the dollar and embracing alternative stores of value, driven by distrust in traditional monetary systems.

The interplay between these trends suggests a future where states and the federal government could support a multi-asset financial system, where dollars, precious metals, and cryptocurrencies coexist as legal tender. Florida’s law could also pave the way for states to experiment with Bitcoin transactions as well, especially if modern payment systems (such as debit cards for precious metals) evolve to seamlessly include digital assets.

New products reflect the convergence

Financial innovation is now starting to reflect this convergence directly. Cantor Fitzgerald announced a Gold Protected Bitcoin Fund that pairs direct Bitcoin exposure with a gold-based downside buffer. This hybrid structure seeks to combine direct Bitcoin exposure with downside protection based on the price of gold.

The fund’s design, featuring uncapped BTC upside with gold as a volatility shield, appears to be built for those hesitant about crypto’s volatility, such as family offices or pension funds, and offers a low-risk entry into digital assets.

Source: www.businesswire.com

Source: www.businesswire.comThis product, and others such as the recently launched Bitcoin & Gold ETP by Bitwise, again reflect the trend of rising demand for gold and Bitcoin as complementary hedges against eroding fiat confidence. The other angle to this, of course, is that Howard Lutnick is both the CEO of Cantor and the informal crypto czar of the current administration. This absolutely contextualizes Cantor Fitzgerald’s pivot into Bitcoin-backed products and structured crypto finance.

The ECB’s gold warning: a revealing signal

In a somewhat unexpected move, the European Central Bank recently flagged gold as a potential systemic risk due to opacity, concentrated trading, and rising demand.

Ironically, much of that demand stems from investors and even central banks seeking a hedge against the very forces that threaten stability in the first place: monetary excess, geopolitical fragmentation, fiat debasement, and unsustainable debt loads.

But this warning may say more about the ECB than it does about gold. Gold, like Bitcoin, exists outside the credit system. It doesn’t rely on trust in central banks, because it’s precisely distrust that gives it value, with demand chiefly driven by protection of capital from the excesses of monetary and fiscal policy.

If the ECB is uncomfortable with growing interest in non-sovereign stores of value, perhaps the question it should be asking is what they’re doing to make these assets look so attractive in the first place?

The store-of-value thesis is evolving

The growing role of Bitcoin and gold in institutional strategy reflects a shift in how risk and resilience are being understood in today’s financial environment. Inflation, fiscal deterioration, and the instability of long-duration government debt are prompting investors and allocators to reconsider traditional assumptions about capital preservation.

Rather than relying solely on fiat-linked instruments, institutional portfolios are evolving to include assets that can perform in structurally different conditions. As demand grows for diversification beyond conventional safe havens, both Bitcoin and gold are increasingly being treated as strategic components of that shift. In many ways, the current environment is revealing how gold’s durability across time can complement Bitcoin’s ability to scale across digital and geographic space.

For more information about our custom research services please get in touch directly, contact us here, or subscribe at www.mckayresearch.com/analysis to get our latest analysis on digital assets trends.

Bitcoin and Gold: Diversifying in a Changing Economic Landscape was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 weeks ago

7

2 weeks ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·