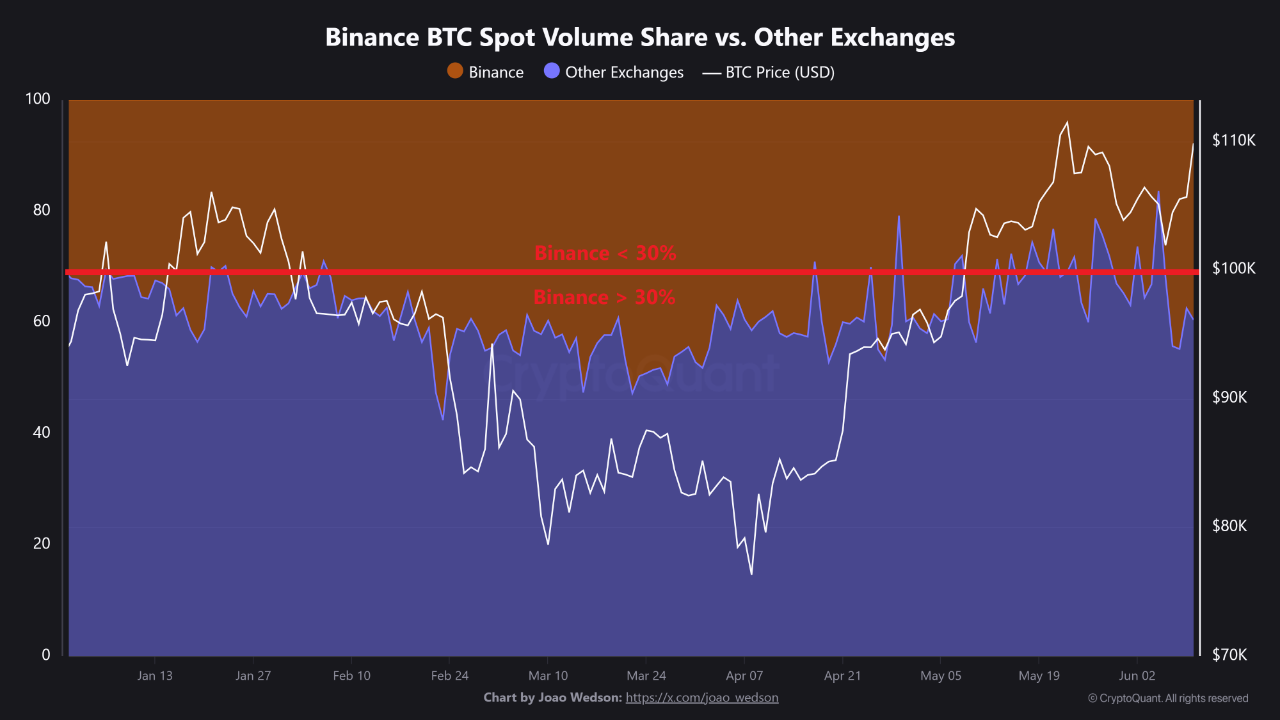

A recent analysis, shared by CryptoQuant, highlights a key market signal: Binance’s share of global spot volume has risen above the 30% threshold—an encouraging sign for BTC bulls.

The chart accompanying the analysis shows that when Binance’s market share is above 30%, Bitcoin price movements tend to be more orderly and liquid. This level of dominance implies that institutional players are active, spreads are tighter, and overall market efficiency improves.

Conversely, when Binance drops below that threshold, it may signal a fragmentation of liquidity toward other exchanges like Coinbase, Upbit, or Kraken. That dispersion often introduces greater volatility and less predictable price action, particularly during periods of macro uncertainty.

Currently, Binance is not only maintaining but regaining dominance. The latest data suggest its spot volume share is solidly above 30%, with the exchange absorbing a larger portion of trading activity. This signals investor trust is returning and that centralized liquidity remains robust.

The trend is especially significant in a market that has recently experienced regulatory pressure, platform exits, and growing competition from decentralized venues.

Binance reclaiming market share suggests renewed confidence and could mark a return to more stable trading conditions across the board.

In short, a dominant Binance is often a calm market. And for now, that’s a bullish signal.

The post Binance Regains Market Share — Why It Matters for Bitcoin’s Price Stability appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·